Alliance Resource Partners Is The Latest Public Company To Hold BTC

The Daily Crypto Update for Institutional Investors

'Diversified Natural Resource Company’ Alliance Resource Partners (NASDAQ: ARLP) Is Running A Pilot BTC Mining Operation Using Excess Electricity At A Mine - The Firm Becomes The Latest Public Entity To Hold BTC On Its Balance Sheet

During an earnings call, Cary Marshall, the firm’s CFO revealed the firm began mining BTC in the first half of 2020 ‘as a pilot project to monetize the already paid-for yet underutilized electricity load at our River View mine’ in Kentucky. Marshall noted that as the quarter concluded, the company held 425 BTC, valued at USD 30M on its balance sheet. After accounting for the net costs associated with property, plant, and equipment, the company's assets increased by USD 7.3M. The rise in fair value is due to the implementation of new accounting guidelines, which allow for the recognition of mark-to-market adjustments in the value of our digital assets over the quarter. The initiative contributed to a 5% earnings increase during the quarter and the company beating revenue expectations.

Alliance Resources, which was founded in 1971 and has a market cap of USD 2.90B, clarified that the firm is ‘not actually out there buying [BTC] or anything of that nature.’ Joe Craft, the firm’s CEO added that Alliance Resource Partners is ‘selling what we need to cover our expenses’ resulting in limited exposure. In Q1 the firm mined 69 BTC and retained 51 of those tokens. Marshall characterized the firm as ‘accumulating [BTC] over time’ and plans to continue doing so: ‘Our costs are lower than where the Bitcoin pricing is today. So, we would anticipate continuing to accumulate points on a monthly basis.’

Asked to comment on the firm’s production costs for BTC, Marshall responded that Alliance Resource Partners mined BTC at an average cost of USD 24,000 per coin in Q1. Marshall acknowledged that the Halving could affect these numbers moving forward.

Takeaway: The BTC strategy implemented by MicroStrategy (NASDAQ: MSTR) involves capital structure management to accumulate the asset. Alliance Resource Partners represents a new strategy: the use of excess electricity to mine BTC below the asset’s market price. The firm’s plans to hold and accumulate BTC suggest that the firm is not agnostic to the asset. This is in contrast to other natural resource firms, such as ConocoPhillips which was reported to be selling excess natural gas to miners. Having said that, MicroStrategy has remained an outlier in its specific BTC strategy. It remains to be seen if Alliance Resource Partners’ approach is more replicable among its industry peers who likely also have excess energy.

CRYPTO HEADLINES

BlackRock’s head of digital assets Robert Mitchnick said he believes sovereign wealth funds, pension funds and endowments may begin trading spot BTC ETFs in the coming months. In an interview, Mitchnick added that BlackRock has seen various financial institutions re-initiate discussions around BTC from a portfolio construction perspective, and that the asset manager has been playing an education role for these firms. - link - @CoinDesk

US-listed spot BTC ETFs experienced their largest aggregate net outflows, USD 563.7M, since inception yesterday. BlackRock’s ETF (NASDAQ: IBIT) had its first day of negative flows, with USD -36.9M, while Fidelity’s ETF (CBOE: FBTC) had USD 191.1M of outflows. Yesterday was the sixth consecutive day of aggregate outflows among the funds. - link - @Farside

MicroStrategy (NASDAQ: MSTR) launched MicroStrategy Orange, a BTC network-based decentralized identity tool. The open-source can allegedly process 10,000 identifiers per transaction. The company seeks to elevate identity security across various applications. - link - @Cointelegraph

Tokenized securities platform Securitize closed a USD 47M funding round led by BlackRock. The investment aims to boost product development and expand global operations. BlackRock's involvement is deepened by one of its Managing Directors, Joseph Chalom, joining Securitize’s board, along with its launch of tokenized BUIDL fund. - link - @Cointelegraph

Agora has raised USD 5M in seed funding to develop its cross-chain governance platform. Led by Haun Ventures with Coinbase Ventures participating, the start-up targets improving decentralized governance protocols. - link - @TheBlock

VanEck estimates that around USD 175B of BTC is held by various formal entities. In a report, the asset manager noted the holdings represent ~15% of the total BTC supply, with diverse holders including ETFs, nations, and both public and private companies. - link - @TheBlock

Baxus, a platform for buying and selling collectible spirits authenticated via Solana-based NFTs, has secured USD 5M in funding. The raise was led by Multicoin Capital, and included participation from Solana Ventures, FJ Labs and Narwhal Ventures. - link - @BAXUS

Block Inc. (NYSE: SQ) is under federal investigation for compliance issues involving its BTC, credit card transactions, and dollar transfers. The company’s Square and Cash App services were flagged as the platforms involving the transactions, with issues relating to customer risk assessment and illicit transactions in sanctioned countries. - link - @NBC

TOP ARTICLES

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

Bitcoin Miner Riot Eyes Selling Power In Texas As Summer Nears, Bloomberg, May 1, 2024

Bloomberg reviews Riot's (NASDAQ: RIOT) participation in public energy policy in Texas.

CRYPTO MULTIMEDIA

Bitcoin Layer 2s Aim To Attract Ethereum-Like Dapps. Will They Succeed? Unchained, April 30, 2024

Alexei Zamyatin, co-founder of Build on Bitcoin, Willem Schroé, founder of Botanix Labs, and Orkun Kılıç, co-founder of Chainway Labs, discuss their projects, which are building layer-2 applications on top of BTC.

CHART OF THE DAY

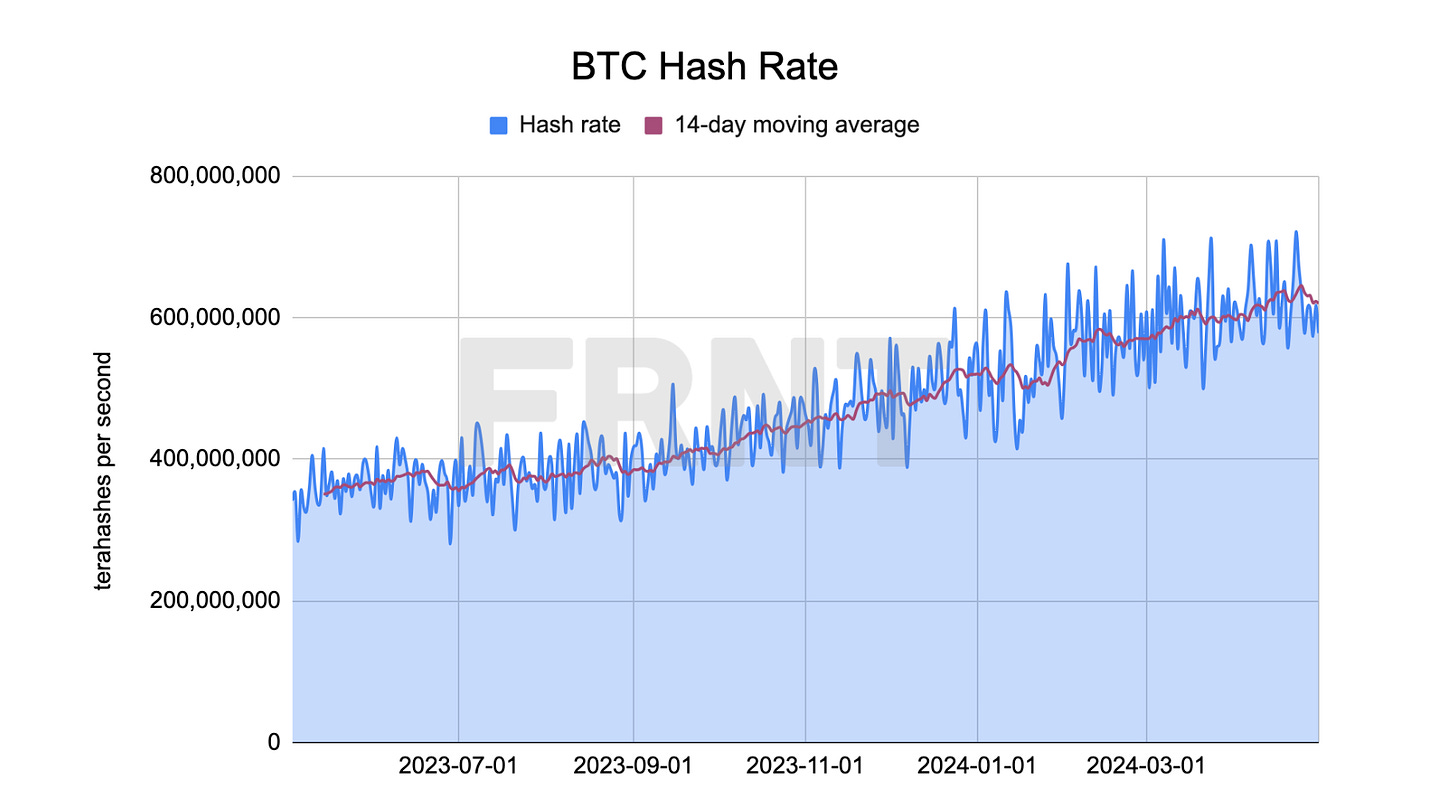

The BTC hash rate has held steady following the Halving, which reduced the reward miners receive per block from 6.25 to 3.125…

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.