Argentina's Economic Liberalization Paves Way For BTC Adoption

The daily crypto update for institutional investors

Argentina's Foreign Minister Diana Mondino Posted On X Yesterday That Financial Contracts In The Country Can Be Denominated In BTC - The Announcement Comes A Day After President Javier Milei Signed A Decree Aimed At Liberalizing The Country’s Economy

On Wednesday, Argentina’s new President Javier Milei signed a decree ‘that will kick-start the process of economic deregulation that Argentina needs so much.’ These efforts are part of broader ‘shock-therapy’ programs Milei had promised. Last week, Economy Minister Luis Caputo announced deep budget cuts and a 54% devaluation of the Argentine peso.

Mondino’s two-part X post, written in Spanish, also noted that besides BTC, contracts can be denominated in any other cryptocurrency or other commodities such as cattle or milk. Mondino then quoted a specific part of the decree Milei had signed: ‘ARTICLE 766.- Obligation of the debtor. The debtor must deliver the corresponding amount of the kind designated, whether the currency is legal tender in the Republic or not.’

Last month, ahead of the presidential election, Diana Mondino, who served as Milei’s economic advisor before being given the role of foreign minister, spoke at a BTC conference in Buenos Aires. Asked if Argentina would make BTC legal tender if Milei were to be elected, Mondino responded that the administration would allow individuals to choose which currencies they transact in.

Takeaway: Last month, when Milei won Argentina’s presidential election, we noted that by allowing individuals to choose which currencies to use, Argentina could become a hotbed for crypto innovation. El Salvador’s national embrace of BTC has seen the country recognize it as legal tender, issue BTC denominated bonds, among other measures. Argentina may emerge as a different approach to the one employed in El Salvador. In that Argentina, authorities, via the liberalization of the economy, may create the conditions for bottom-up adoption of BTC.

CRYPTO HEADLINES

Hong Kong regulators said they are prepared to accept applications from issuers seeking to list spot-based crypto ETFs. In a joint circular published by the Securities and Futures Commission and the Hong Kong Monetary Authority, the regulators described the shift in their approach to regulate the industry, initially focusing on professional investors, and now shaping rules for products to service retail. In August, HashKey Pro and OSL became the first two entities to receive a license permitting them to provide crypto trading and custody services to crypto. - link - @SFC

The SEC met with a number of filers, including BlackRock (NYSE: BLK) and Valkyrie, to discuss spot BTC ETF applications this week. The meetings were seemingly focused on practicalities of the ETFs, including ‘cash’ over ‘in-kind’ redemption mechanisms. - link - @JamesSeyffart

Bankrupt BTC miner Core Scientific said it ‘expects to emerge from Chapter 11 in mid-to-late January.’ The miner filed for bankruptcy almost exactly one year ago, and at that time was estimated to be the largest miner by hash power. - link - @Reuters

Coinbase (NASDAQ: COIN) announced it has obtained a license from the Autorité des Marchés Financiers to operate in France. The company noted the license, called the Prestataire de Services sur Actifs Numériques (PSAN), allows it to service both retail and institutional customers with custody and trading products. - link - @COIN

Elon Musk said he does not ‘spend a lot of time thinking about cryptocurrency — hardly any at all’ during a live conversation with Cathie Wood on X. Musk has revealed personally owning BTC, ETH and DOGE. - link - @TheBlock

Crypto brokerage startup received approval from the Financial Industry Regulatory Authority (FINRA) to offer clearing and custody services. In May, the company received a ‘first-of-its-kind approval’ from FINRA to operate as a ‘special purpose broker-dealer’ for crypto. The company intends to begin offering custody services next quarter and eventually launch institutional and retail trading. - link - @TheBlock

TOP ARTICLES

Bloomberg: The 11 Big Trades of 2023: From Market Busts To Career-Making Wins

WSJ: Bitcoin Rose On Rumors In 2023. How To Predict What Comes Next.

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

An Old SBF Favorite Becomes Crypto’s Next Big Thing, Bloomberg, December 21, 2023

FRNT's (TSXV: FRNT) head of data and analytics Strahinja Savic discusses Solana's performance in 2023.

CRYPTO MULTIMEDIA

Bitcoin Will Continue To Move Forward In 2024, Says MicroStrategy's Michael Saylor, CNBC, December 20, 2023

MicroStrategy (NASDAQ: MSTR) executive chairman Michael Saylor shares his outlook for BTC in 2024

CHART OF THE DAY

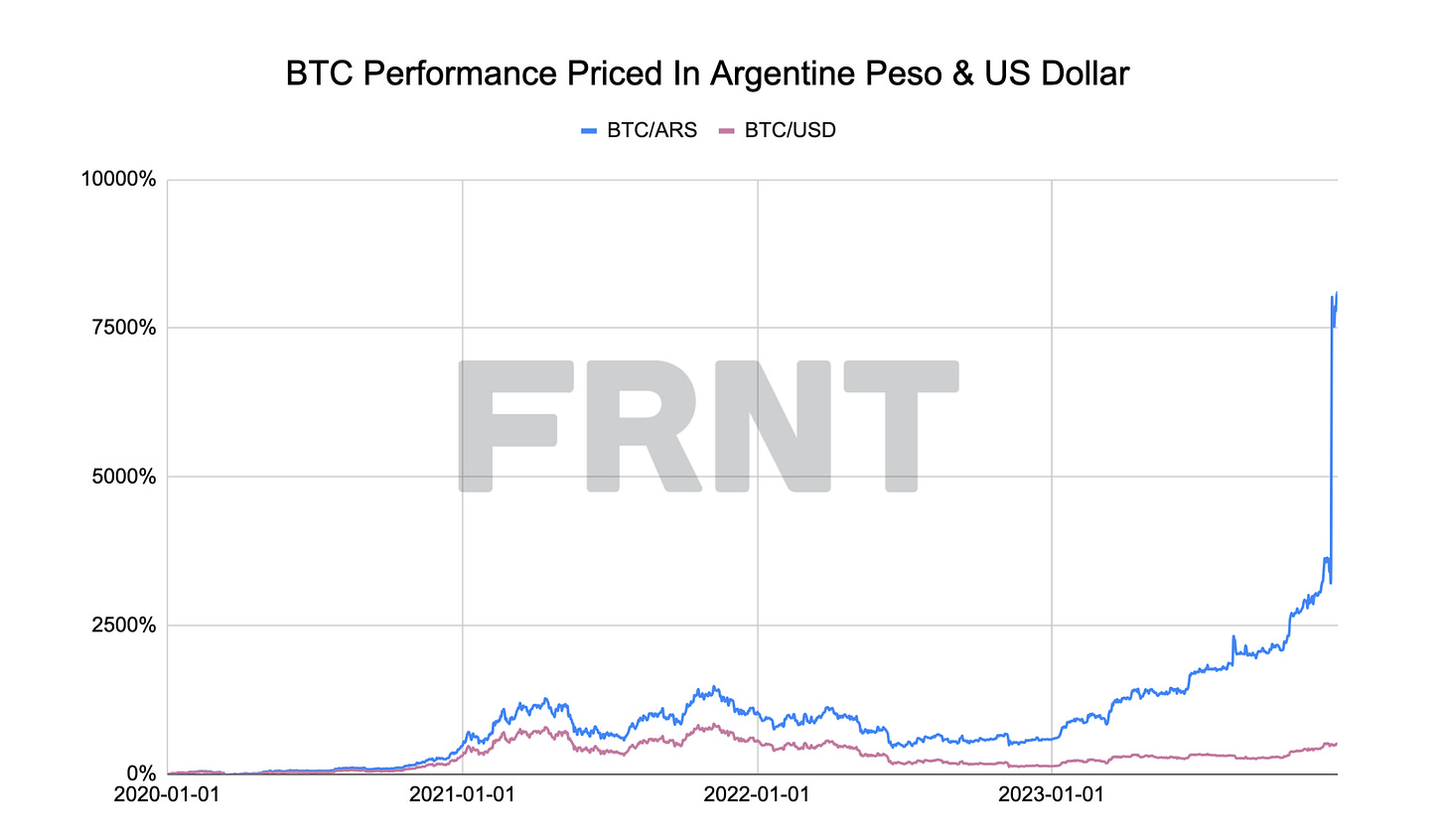

Priced in USD, BTC is currently 36% below its November 2021 record high. However, against the Argentine peso, which was devalued by 50% last week, BTC is making new record highs…

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.