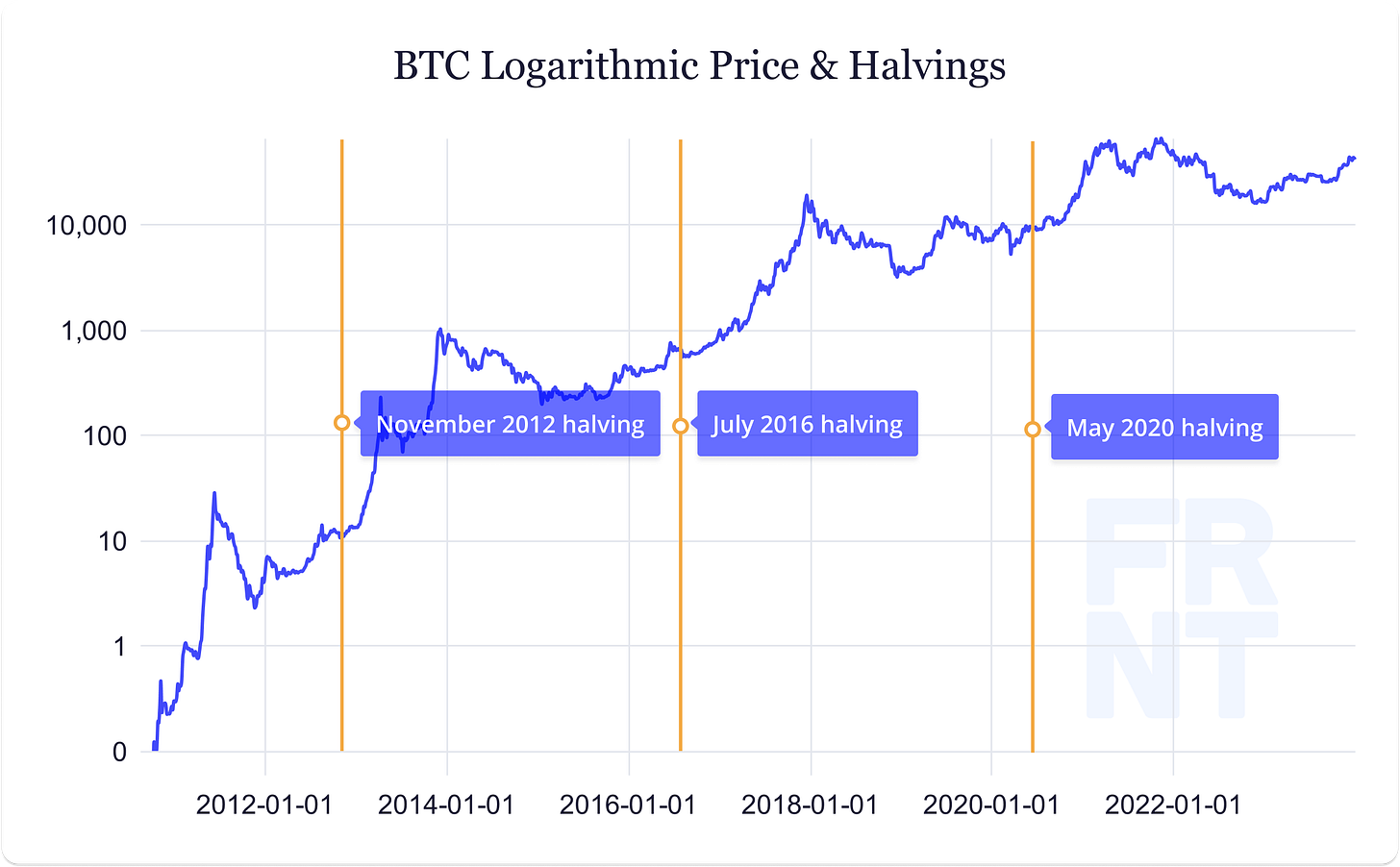

Among The Bullish Narratives That Have Driven BTC’s Performance In 2023 Is The BTC Halving, Scheduled To Take Place In April - We Provide An Overview Of The Event In This AM’s Note

BTC halvings are not scheduled by date but rather by block height, i.e. every 210,000 blocks a halving occurs. Given that it takes ~10 minutes to add a new block to the BTC blockchain, halvings occur every ~four years. By design or coincidence, this has lined up halvings to occur in the same year as US presidential elections. In practical terms, halvings cut the reward miners receive per block by 50%. In April, the current block reward of 6.25 BTC will become 3.125 BTC. This pattern will continue until the maximum supply of 21M BTC is reached, around the year 2140.

The programmatic nature of halvings ensures that BTC’s inflation rate is transparent and immutable. In addition, halvings are described as decreasing the downward sell pressure that comes from miners. Halvings, which have historically preceded rallies have also ignited debate over the extent to which they are ‘priced in.’

Havings also have a significant impact on BTC miners as they reduce the proportion of revenue derived from the block reward in favour of revenue derived from transaction fees. This has led to the view among some that BTC transaction fees need to rise in order to ensure the long-term viability of miners.

Beyond the BTC halving, historically, technical milestones in crypto have caused associated tokens to rally. For instance, ETH rallied ~80% in the three months preceding its crucial Merge upgrade in September 2022. Technical milestones have served as an opportunity for proponents of an asset to highlight its selling points.

Takeaway: BTC proponents describe the halving as a crucial part of the token’s design. Previously, halvings have served to highlight BTC’s programmatic and a-priori defined monetary policy. Considering that the 2024 halving may occur only months after the potential launch of a dozen BTC ETFs, some proponents have argued that this halving could see amplified discussions surrounding the token’s inflation characteristics and other selling points. While previous halvings were often a niche topic for BTC enthusiasts, the potential ETF issuers may bring the topic to a much wider audience.

CRYPTO HEADLINES

TechCrunch reporter Jacquelyn Melinek said she heard from sources the SEC will approve multiple BTC spot ETF applications. Melinek described the sources as ‘extremely close to the matter,’ added that more is expected to be revealed today. - link - @JacquelynMelinek

The SEC has filed motions in its cases against Coinbase (NASDAQ: COIN) and Binance asking the court to consider rulings in its case against Terraform Labs. Last week, a US judge ruled that Terraform Labs violated securities laws, and that the tokens LUNA and MIR were illegally sold to the public as unregistered securities. In its suit against Coinbase, the SEC argued a number of tokens, not including LUNA or MIR, were listed on the platform as unregistered securities. In its case against Binance, the SEC highlighted the Terraform Labs case in opposition to Binance’s motion to dismiss the suit. - link - @TheBlock

Crypto investment manager Bitwise found that 39% of financial advisors believed a BTC ETF would be approved in 2024 in a recent survey. The manager, which is one of the prospective issuers awaiting a decision from the SEC, also found that 88% of respondents interested in investing in the asset were waiting for an ETF to be approved. - link - @Bitwise

Bankrupt crypto lender Celsius said it has begun unstaking its ETH holdings in preparation for repayments to creditors. Crypto data site Nansen estimates the firm currently has USD ~465M worth of ETH staked, and has unstaked USD ~90M worth to-date. Under its recently approved restructuring plan, the company plans to repay eligible creditors in BTC and ETH. - link - @Cointelegraph

BTC miner Marathon Digital (NASDAQ: MARA) announced it produced a company-record 1,853 BTC, worth USD ~81M, in 2023. The company attributed the growth to higher fees, with 22% of its production coming from fees paid to miners for processing transactions on the network. - link - @MARA

Crypto analytics firm TRM Labs estimates North Korea was connected to USD 600M of crypto-related hacks in 2023. The company found that hackers tied to the country were responsible for a third of all theft resulting from crypto hacks last year. In 2022, TRM Labs estimates North Korea was responsible for USD 850M in hacks, and since 2017 is connected to over USD 3B in theft. - link - @TRMLabs

South Korea's Financial Services Commission proposed banning the use of credit cards to purchase crypto on exchanges. The regulator opened the proposal to public comment over the next month, explaining that the move may mitigate the illegal outflow of domestic funds overseas. - link - @CoinDesk

Binance.US has hired Lesley O'Neill as its Chief Compliance Officer. O'Neill was formerly CCO of Prove Identity, a digital ID verification platform used by financial services firms. The exchange’s prior CCO, Tammy Weinrib, left the firm in November. - link - @TheBlock

TOP ARTICLES

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

Coinbase’s Huge Role In Proposed Bitcoin ETFs Raises Big Questions, Bloomberg, January 4, 2024

Bloomberg discusses the role of Coinbase (NASAQ: COIN) in potential spot BTC ETFs.

CRYPTO MULTIMEDIA

2024, The Year Of The Bitcoin Bull With Lyn Alden, Bloomberg, January 1, 2024

Macro strategist Lyn Alden shares her view on BTC's outlook in 2024.

CHART OF THE DAY

BTC halving events have previously preceded rallies...

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.