Cantor Fitzgerald CEO Howard Lutnick Compares USDC & USDt

The Daily Crypto Update for Institutional Investors

Cantor Fitzgerald CEO Howard Lutnick Contrasted USDC & USDt At The ‘Bitcoin 2024’ Conference, Stressing The Latter Token’s Ability To ‘Create Liquidity On US Treasuries Instantly’

Speaking at the ‘Bitcoin 2024’ Conference in Nashville, Lutnick explained that Tether’s USDt ‘has every penny and it can produce liquidity on a moment's notice because they have their US treasuries with Cantor Fitzgerald, a primary dealer who can create liquidity instantly.’ Lutnick gave the example of FTX redeeming 10B USDt in ‘two or three days because he assumed they wouldn't have the liquidity.’ This episode, however, was before Cantor Fitzgerald was revealed to be holding Tether's treasuries, the CEO points out. Lutnick concluded his point by stressing, ‘we met 10 billion in redemptions instantly because it's no big deal for us. We deal in trillions of Treasuries; it's nothing for us.’

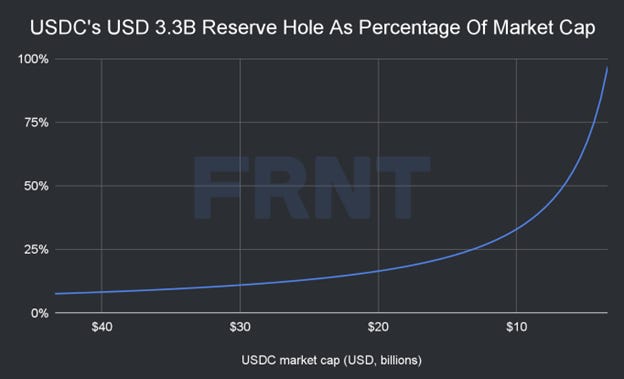

Lutnick claims USDt’s reliance on highly liquid US treasuries differentiates it from Circle USDC stablecoin: ‘Think about it: Circle had USD 3.3B of your reserves uninsured in the Silicon Valley Bank when it went bust.’ Last year, following the collapse of SVB heading into a weekend, Circle announced it would resume redemptions on the following Monday. This announcement was made before officials revealed an intervention that would make all SVB depositors whole once banks opened on Monday. As such, Circle was willing to resume USDC redemptions despite lacking certainty over its ability to fill a USD 3.3B hole in its reserves.

Tether’s reserves have been the subject of controversy, largely fueled by unfounded speculation of its reserves. Lutnick’s repeated assertions that Tether has ‘the money they say they have’ has served to alleviate some anxiety regarding the reserves.

Since the collapse of SVB, USDt’s market cap has increased by USD ~41B, to a current USD 114B. During the same period, USDC’s market cap has dropped by USD ~11B, and is currently USD 33B.

Takeaway: Circle’s USDC has yet to recover above its 2022 record high market cap of USD 55B. The stablecoin also remains below its pre-SVB collapse levels. On the other hand, since the SVB episode, Tether’s USDt has consolidated its dominance of the stablecoin market. In March, when USDt’s market cap surpassed USD 100B for the first time, we pointed that Tether has emerged as a ‘highly profitable and viable firm,’ contributing to the confidence users have placed in the token. In addition, USDt has become a notable financial instrument in emerging markets; the stablecoin represents a highly viable means of escaping acute financial conditions in jurisdictions such as Turkey or Argentina.

CRYPTO HEADLINES

US Senator Cynthia Lummis proposed funding the planned ‘Strategic Bitcoin Reserve’ by revaluing Federal Reserve gold certificates. Draft legislation cited by CoinDesk includes proposing that the Treasury secretary establish a distributed ‘decentralized network of secure Bitcoin storage facilities’ across the US. The plan, announced at the Bitcoin 2024 conference last weekend, involves a ‘Bitcoin Purchase Program’ of 1M BTC over 5 years. - link - @CoinDesk

Presidential candidate Donald Trump's campaign received USD 21M in donations at a ‘Bitcoin 2024’ fundraiser, according to the conference’s CEO. The Nashville-based event saw 100 attendees contributing to the campaign's finances. Prior to the event, Trump’s campaign raised USD 4M in crypto, with the majority of donations in BTC. - link - @TheBlock

Stablecoin issuer Circle’s equity has been valued between USD 5B and USD 5.25B in secondary markets. The shares are being sold by early-stage investors and employees of the company, as the company prepares for a potential IPO. - link - @TheBlock

US spot ETH ETFs experienced net inflows of USD ~34M yesterday, ending a four-day negative streak. The inflows were led by BlackRock's ETHA with USD ~118M, despite Grayscale's ETHE logging USD 120.3M in outflows. Total trading volume for these ETFs was USD 563M during the trading session. - link - @TheBlock

Lloyd's of London has introduced digital asset protection policies using the Ethereum blockchain, with premiums payable in crypto. The collaboration with Evertas and Nayms is a milestone for insurance services in the crypto sector, promoting blockchain adoption for improved efficacy. Evertas offers policies with a maximum cover of USD 200M for each mining facility. - link - @CoinDesk

California's DMV digitized 42 million car titles on the Avalanche blockchain in an effort to modernize title transfers. This initiative, in collaboration with blockchain development firm Oxhead Alpha, allows users to manage titles digitally via the DMV app, aiming to reduce transfer times from two weeks to minutes. - link - @Avalanche

DraftKings closed its NFT business, citing ‘recent legal developments.’ Following a ruling by a federal judge, a class action lawsuit against the company's NFTs as unregistered securities will proceed. DraftKings had introduced its NFT platform in 2021, emphasizing sports-related digital collectibles on Ethereum and Polygon. - link - @CoinDesk

Hyperbolic secured USD 7M in seed funding to improve AI computing through blockchain technology. The investment round, headed by Polychain Capital and Lightspeed Faction, will be used to support the development of Hyperbolic's vision to create a decentralized AI ecosystem. - link - @Hyperbolic

TOP ARTICLES

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

MiCA’s Stablecoin Regime And Its Remaining Challenges: Part 3, Chainalysis, July 3, 2024

Chainalysis examines stablecoin regulation in the EU.

CRYPTO MULTIMEDIA

Crossroads: TradFi & Bitcoin W/ Howard Lutnick, 'Bitcoin 2024,' July 30, 2024

Howard Lutnick speaks at the ‘Bitcoin 2024’ conference in Nashville outlining his support for BTC and Tether.

CHART OF THE DAY

As we noted last year, arbitrage incentives would have pushed USDC's market cap lower, increasing the relative size of the reserve hole, should the firm has moved forward with redemptions in tandem with a lack of clarity over the missing USD 3.3B held by SVB.

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.