Comparing Crypto In November 2021 To November 2025

The Daily Crypto Update for Institutional Investors'

On November 10, 2021, BTC achieved a cycle high of USD ~69,000 - We discuss some of the changes that have transpired in the four years since

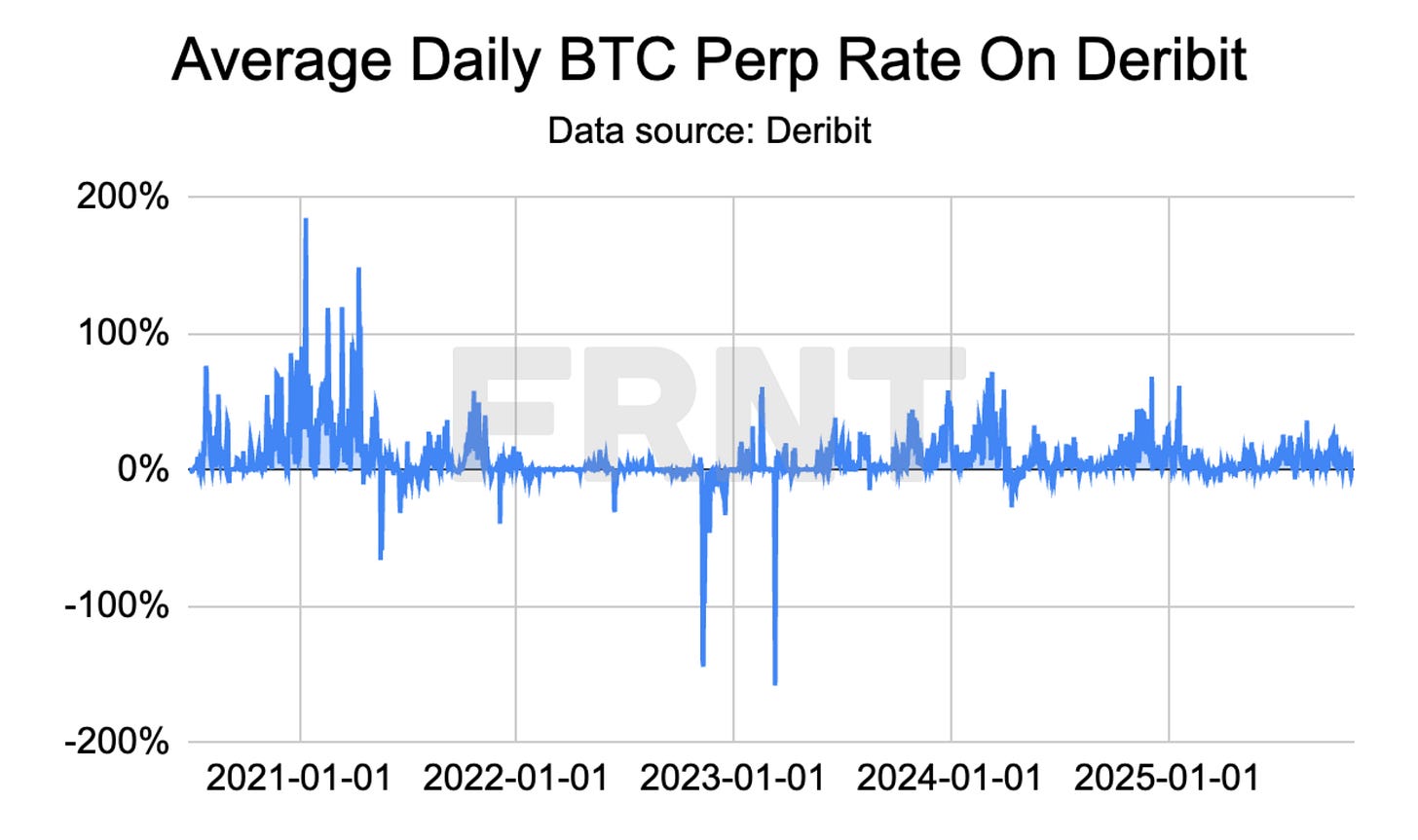

Leverage & froth were significant in 2021: We have frequently pointed out that demand for leverage and risk in crypto has remained relatively tepid in 2025. Core leverage metrics in 2025 and 2024 have not reached levels seen in 2021. For instance, in November 2021 the average daily BTC perp rate on Deribit reached 185%. Fast forward to the past year, this metric reached a high of 61% for 2025 in January, underscoring the more benign market conditions compared to 2021. We have also pointed out the excess of the NFT space in 2021 and 2022 to underscore the risk-appetite of the cycle; in 2025, no such ‘craze’ exists. In December of last year, we described memecoins as ‘an early candidate for this cycle’s “craze,” similar to NFTs in 2021.’ However, memecoins continue to struggle in 2025 and the aggregate market cap of this cohort of assets is down ~60% since December 2024.

In 2021 crypto was a pariah asset class: In 2021, for many traditional market participants, crypto was a very separate and segregated asset class. In 2025, the distinction between crypto and traditional markets is blurring. Most notably, this change has been actively supported by the Trump Administration. From Vice President JD Vance describing BTC as ‘becoming a strategic asset for the US’ to the US Federal Housing Finance Agency studying ‘the usage [of] cryptocurrency holdings as it relates to qualifying for mortgages,’ crypto is being actively supported and embraced by the Trump Administration. This has resulted in a plethora of examples of crypto’s growing presence in traditional markets and incumbent financial institutions taking initial steps to embrace digital assets. Treasury Secretary Bessent’s X post yesterday indicating that the Treasury and IRS have ‘issued new guidance giving crypto [ETFs] a clear path to stake’ underscores the elevated status digital assets are enjoying in 2025 compared to 2021.

In 2021, stablecoins were a point of concern for many: In 2021, Tether’s reserves were often described with scepticism, especially among mainstay financial news outlets. Bloomberg, for instance, published an article titled ‘Anyone Seen Tether’s Billions?’ in October 2021. For many traditional market practitioners, such headlines served to entrench scepticism towards crypto. In 2025, concerns over Tether’s reserves couldn’t be more distant. Stablecoins now enjoy the full bipartisan support of the US government and are seen as a new strategic buyer of US debt. This turn-around is best underscored by Tether launching a US-focused stablecoin, USAT, something that would have been unimaginable in 2021.

In 2021 crypto’s regulatory overhang was significant: It is difficult to overstate the extent of regulatory complexity faced by the crypto space in the prior cycle. Former SEC Chairman Gary Gensler went as far as to suggest staking – an activity that is core to the functioning of most blockchains – implicated securities laws. Headlines regarding probes of Binance, the largest crypto exchange by trading activity, were frequent, to name just some of the regulatory complexity faced by the digital asset space. In 2025, the Trump Administration has systematically dismantled crypto’s regulatory overhang.

CRYPTO HEADLINES

New guidance from the US IRS allows ETFs without affecting their tax status. The rule, effective immediately, is described as removing a key legal barrier for crypto funds and clarifying regulatory and tax treatment of proof-of-stake participation. - link - @CoinDesk

A bipartisan draft bill introduced by US senators Boozman and Booker proposes shifting crypto market oversight from the SEC to the CFTC and classifying most cryptocurrencies as digital commodities. The bill introduces new registration, disclosure, and fee requirements, but leaves disagreements on DeFi and anti-money-laundering unresolved. - link - @Bloomberg

China’s cybersecurity agency accused the US government of participating in a cryptocurrency theft involving 127,000 BTC, stolen in 2020 from the LuBian mining pool. The US Department of Justice is described as seizing the BTC, with Chinese authorities disputing its legitimacy. US officials claim lawful action. - link - @CoinDesk

Tether is hiring HSBC Holdings Plc’s global head of metals trading and head of precious metals origination for EMEA to expand its gold reserves. Tether, which held more than USD 12B in gold by September 2025, has emerged a top market buyer, writes Bloomberg. - link - @Bloomberg

Coinbase (NASDAQ: COIN) is launching a UK savings account. The product offers eligible users 3.75% AER variable interest, instant access, and FSCS protection up to GBP 85,000. Rollout will expand progressively. - link - @TheBlock

Brazil’s central bank finalized regulations that classify stablecoin and some self-custody wallet transfers as foreign-exchange operations, extending banking-style oversight to crypto activities. The framework takes effect February 2, 2026, imposing stricter reporting and operational requirements for licensed providers. - link - @Cointelegraph

Gemini (NASDAQ: GEMI) reported a USD 159.5M net loss for Q3 2024, or USD 6.67 per share, due to high marketing and IPO costs. Revenue reached USD 50.6M, more than double the prior year, with growth attributed to trading and non-exchange products. Shares fell ~8% pre-market trading. - link - @CoinDesk

JPMorgan (NYSE: JPM) and Singapore’s DBS Bank (SGX: D05) are developing a system to enable institutional clients to transfer tokenised deposits across blockchain networks. The project would connect the banks’ closed blockchain networks for cross-bank settlements. - link - @CoinDesk

Standard Chartered partnered with DCS Card Centre to support DeCard, a credit card enabling stablecoin spending in Singapore. The collaboration targets fiat and stablecoin settlements, with expansion into additional markets planned. - link - @STAN

BTC miner CleanSpark (NASDAQ: CLSK) has announced plans to offer USD 1B of convertible senior notes due February 15, 2032, with an option for an additional USD 200M, subject to market conditions. Proceeds may be used for stock repurchase, expansion, debt repayment, and corporate needs. - link - @CLSK

TOP ARTICLES

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

Circle’s Billionaire CEO Plays By the Rules in Crypto Wild West, Bloomberg, November 11, 2025

Bloomberg discusses stablecoin issuer Circle.

CRYPTO MULTIMEDIA

Bitcoin Hammered by Long-Term Holders Dumping $45 Billion, Bloomberg, November 6, 2025

Senior Commodity Strategist for Bloomberg Intelligence Mike McGlone shares his view on BTC market dynamics.

CHART OF THE DAY

BTC perp rates on Deribit remain subdued in the latter half of 2025, especially compared to 2021.

About FRNT Financial

FRNT is a digital asset investment bank offering capital markets and advisory services to institutional investors participating in or entering the space. The Company aims to bridge the worlds of traditional and web-based finances with a technology forward and compliant operation. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting, lending origination and principal investments. Headquartered in Toronto, FRNT was co-founded in 2018 by CEO Stéphane Ouellette.