ETH’s underperformance has been a defining feature of crypto markets in 2024 and 2025 - The network, however, still dominates DeFi liquidity and stablecoin distribution compared to other blockchains

ETH, priced in BTC, is testing historical lows. Since December 2021, a ~3.5 year high for the pair, ETH/BTC has declined by 74%. Priced against USD, ETH is currently 58% below its 2021 record high price of USD 4,800.

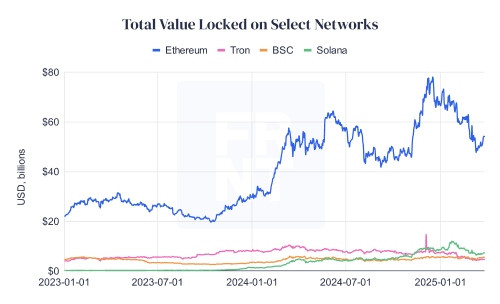

However, despite what has proven to be disappointing price appreciation for ETH proponents, the Ethereum network continues to be dominant smart contract platform on several fronts:

Stablecoin deployment: There are USD 210.41B worth of stablecoins deployed on Ethereum, Tron, BSC and and Solana. 60% of this stablecoin value is deployed on Ethereum, followed by 30% on Tron. (Data source: DeFiLlama)

TVL: Between Ethereum, Tron, BSC and Solana, there is USD 71.75B worth of crypto deployed in DeFi smart contracts. Ethereum accounts for 75% of the total value locked (TVL) across these four networks. (Data source: DeFiLlama)

In practical terms, what this translates to is more efficient market conditions on Ethereum. For instance, Aave, the largest DeFi lending platform, has a total of USDC 2.77B supplied to its Ethereum smart contract available for borrowing. Users who wish to borrow USDC from the Ethereum version currently pay a rate of USD 5.08%. On the Base version of Aave the cost to borrow USDC is 5.11%, with the difference between these two rates typically wider than it currently is. However, there is only USDC 149.6M supplied to the Base version of Aave. This not only limits how much USDC is available to be borrowed, but also means that significant loans are likely to increase rates (lending rates on Aave are highly sensitive to how much of the supplied crypto is borrowed).

On the second largest DeFi lending venue according to DeFiLlama, Tron’s JustLend, users are able to borrow USDt for 4.55% from a pool of USDt 40.99M. By comparison, on the Etereum version of Aave, there is USDt 3.45B supplied with the cost to borrow 4.29%. On JustLend as well, significant loans of USDt would impact the cost to borrow.

Takeway: Ethereum detractors have postulated that the smart-contract network could lose market share to faster and cheaper networks. However, the network continues to dominate core DeFi metrics and market conditions on Ethereum offer key advantages compared to other blockchains. It remains to be seen how competing networks will incentivize and attract new users in order to improve the aforementioned conditions.

CRYPTO HEADLINES

During his Senate confirmation hearing, SEC nominee Paul Atkins assured a new crypto regulatory stance but faced few substantial crypto-related inquiries. Atkins promised to provide 'a firm regulatory foundation for digital assets through a rational, coherent, and principled approach,' contrasting his predecessor Gary Gensler. Meanwhile, OCC nominee Jonathan Gould committed to easing banking oversight strains on the crypto industry. - link - @CoinDesk

The UK's Financial Conduct Authority is set to implement a new crypto regulatory regime by 2026. In an interview with CoinDesk, FCA director of payments and digital assets Matthew Long highlighted a move from AML registration to a new authorization regime, requiring new approval processes. - link - @CoinDesk

French public investment bank Bpifrance announced plans to invest up to EUR 25M in French crypto projects. This move, announced at an event with Clara Chappaz, aims to enhance France's position in emerging technologies. - link - @Bpifrance

Galaxy Digital (TSX: GLXY) agreed to a USD 200M settlement with the New York Attorney General over the collapsed Terra (LUNA) project. The settlement addressed alleged violations in promoting LUNA while Galaxy allegedly profited massively by selling LUNA tokens without disclosure. - link - @TheBlock

The US SEC officially dropped cases against Kraken, Consensys, and Cumberland DRW yesterday. The prior allegations included operating unregistered services. Separately, Crypto.com announced it was informed by the agency it will no longer be investigated after having received a Wells notice in October. - link - @TheBlock

The Sei Foundation announced its exploration of acquiring 23andMe (NASDAQ: ME) as part of a ‘decentralized science’ initiative. The foundation described deploying the bankrupt company’s platform on its layer-1 blockchain, Sei, returning data ownership to users through encrypted transfers, and allowing users to choose data monetization. - link - @Sei

Abound, a remittance app, raised USD 14M in a seed round with investments from Circle Ventures and the Near Foundation. Abound, incubated by the digital arm of the Times of India Group, aims to serve NRIs, having processed USD 150M in remittances, with 500k monthly active users. - link - @CoinDesk

Crypto VC Maven 11 has closed its third fund after raising USD 107M. The fund, supported by Theta Capital Management and others, exceeded its USD 100M target and plans to deploy over 3-4 years. - link - @TheBlock

CoreWeave Inc. raised USD 1.5B in its IPO, selling 37.5M shares at USD 40 per share. Initially targeting up to USD 2.7B, the revised offering values the firm at USD 23B. - link - @Bloomberg

TOP ARTICLES

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

Bitcoin and Bonds: Have MicroStrategy and GameStop Found a Cheat Code for Markets? The WSJ, March 28, 2025

The WSJ reacts to GameStop's new BTC strategy.

CRYPTO MULTIMEDIA

Solana, XRP, or Doge ETFs? | Bloomberg's James Seyffart on Crypto ETFs: Performance & Launch Dates, Binance, March 24, 2024

Bloomberg Intelligence ETF Analyst James Seyffart discusses crypto ETFs.

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.