ETH's Underperformance Becoming Defining Feature Of 2024

The Daily Crypto Update for Institutional Investors

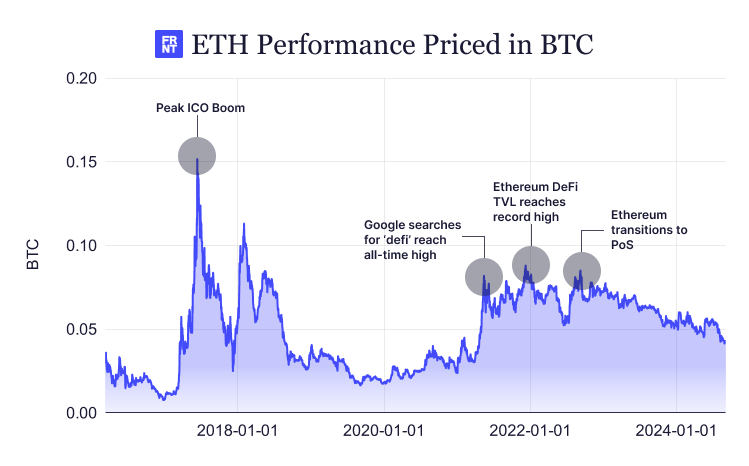

ETH’s Underperformance Has Emerged As A Defining Feature Of The Crypto Market In 2024, Although The Trend Has Been Persisting For Years - Priced In BTC, ETH Is Now Down ~71% Since A June 2017 All-Time High

Relative to BTC, ETH made a record high in June of 2017. This was a period when the crypto ecosystem was in the midst of the ‘ICO craze.’ This period was marked by projects raising funds via the public sale of tokens. A research report titled 'Comparing the ICO Boom of 2017/18 and the NFT Boom of 2021' highlights that in June 2017, the amount of capital raised through ICOs exceeded traditional VC funding obtained by crypto startups. ICOs generated USD 550M, whereas angel and seed VC investments totaled only USD 300M. June 2017 also marked the beginning of what ended up being the largest ICO ever, the EOS raise. Block.one, the firm behind the EOS network, raised a blockbuster USD 4.1B. ICOs fueled demand for ETH, as the Ethereum native currency became the primary means of investing in these projects.

Ultimately, though, ICOs proved to be unsustainable, especially from a regulatory perspective. In July 2017, the SEC put out the ‘DAO Report,’ which laid the groundwork for why ICOs were implicating securities laws. Today, ICOs in their original form, are virtually non-existent and are hampered by a wide range of legal precedent.

In December 2021, ETH/BTC achieved its highest level outside of the ICO phase, but remained ~41% below the June 2017 high. This time Ethereum’s performance was driven by interest in DeFi. One month ahead of this peak, the value of capital deployed in Ethereum-based DeFi reached a record high of USD 106B. Broadly speaking, ETH became the primary asset for speculating in DeFi, and was used to fund a wide range of transitions on these venues.

Since 2021, however, the value of capital deployed in Ethereum-based DeFi has declined by ~52% to a current estimated USD 47B, according to DeFiLlama. In addition, there has been greater clarity over DeFi’s regulatory status. Initially, some DeFi proponents argued the sub-space could avoid regulatory scrutiny due to its novel technical nature, but this has not played out in practice.

Finally, in September 2022, ETH/BTC reached its second highest level post ICO phase. In this instance, the performance was driven by Ethereum’s transition to proof-of-stake (PoS). The transition was seen as ushering in a new era of scalability and economics for ETH, with holders now being able to earn a yield on the token. Since the PoS transition, ETH/BTC is down ~50%. The success of Ethereum’s scaling efforts, including those via layer-2s, remain unclear and will continue to play out for years to come.

Takeaway: ETH trading has been highly narrative-driven. ETH/BTC peaks can be attributed to select narratives that have a track record of falling short of initial expectations. At the same time, the network’s differentiated use-case has become less clear; numerous other networks, including BTC, offer layer-2s, smart contracts and the ability to issue assets. In 2024, Ethereum remains in search of a new narrative.

CRYPTO HEADLINES

Crypto investors and executives are planning a fundraiser to support Vice President Kamala Harris and encourage a softer regulatory stance for the industry. Scheduled for September 13, the event aims to raise at least USD 100,000, with tickets priced between USD 500 and USD 5,000. Organizers hope Harris will ease crypto regulations if elected, contrasting with the current SEC's strict enforcement under Biden. - link - @Reuters

The SEC opposed the FTX bankruptcy estate’s plan to use stablecoins for repaying creditors. The regulator, supporting the US Trustee's stance, contested a discharge provision that could curtail future legal claims against FTX's assets. Although FTX intends to settle creditor debts with cash or stablecoins tied to the US dollar, the SEC has objected, especially as some creditors favor repayment in cryptocurrencies. The SEC maintains authority to dispute any crypto-related transactions. - link - @TheBlock

Trump-endorsed DeFi project World Liberty Financial announced Corey Caplan, co-founder of dolomite.io, as an advisor to the yet-to-launch platform. Dolomite is described as a money market and margin trading protocol operating on several Ethereum layer-2 networks. In its announcement, World Liberty Financial teased Caplan as ‘the first of many incredible people’ to be shared ‘over the coming days.’ - link - @TheBlock

Telegram reported holding USD 400M worth of crypto at the end of 2023. The messaging platform reached four million premium subscribers by the end of that year, and has since seen growth to over five million. Although the company's revenue for 2023 was USD 342.5M, it incurred an operating loss of USD 108M, with crypto-related activities accounting for 40% of its revenue. - link - @Cointelegraph

Global crypto investment products experienced net outflows of USD 305M last week, according to a report from CoinShares (STO: CS). This reversal follows net inflows of USD 543M the previous week, with negative sentiment particularly impacting BTC-based products. - link - @CS

OKX was granted a Major Payment Institution license by the Monetary Authority of Singapore. The exchange is now authorized to provide digital payment token services and cross-border money transfer services within the country. - link - @OKX

Qatar has launched a new regulatory framework for digital assets. The rules, published by the Qatar Financial Centre, focus on tokenization, property rights in tokens, and smart contracts. The development diverges from Qatar's previous stance in 2018, which prohibited crypto activities. - link - @CoinDesk

Ripple plans to integrate Ethereum-compatible smart contracts into its XRP Ledger via a new sidechain. The enhancement would allow for applications such as decentralized exchanges and token issuance to interact with the protocol. The sidechain, using the Axelar network for cross-chain transfers, will use Wrapped XRP (eXRP) to facilitate interoperability. - link - @CoinDesk

BTC miner Rhodium Encore secured court approval to obtain financing from Galaxy Digital (TSX: GLXY) in its Chapter 11 bankruptcy. Rhodium was offered either USD 30M or 500 BTC, with respective interest rates of 14.5% and 9.5%. The miner filed for bankruptcy last month amid disputes with its landlord and power supplier er Whinstone, a subsidiary of Riot Platforms (NASDAQ: RIOT). - link - @Bloomberg

TOP ARTICLES

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

Australia Leads The World In Crypto ATM Growth As Kiosks Pour In, Bloomberg, August 29, 2024

Bloomberg covers the proliferation of BTC and crypto ATMs in Australia.

CRYPTO MULTIMEDIA

If The SEC Sues OpenSea, Here’s Why The NFT Platform Could Win Easily, Unchained Podcast, August 30, 2024

Crypto-focused lawyer Preston Byrne shares his view on the recent developments regarding the SEC and OpenSea.

CHART OF THE DAY

ETH/BTC has emerged as a chart of 2024. ETH continues to struggle to find a narrative with traction...

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.