Judge Allows SEC Case Against Coinbase To Move Forward

The Daily Crypto Update for Institutional Investors

A US Judge Has Ruled That The SEC’s Case Against Coinbase (NASDAQ: COIN) Can Proceed On Most Of The Regulator’s Charges - The SEC Maintains That Existing Rules Apply, Despite Crypto Technical Novelty

The SEC’s charges & the judge’s decision: In June of last year, the SEC charged Coinbase with operating as an ‘unregistered national securities exchange, broker, and clearing agency’ and for failing to register its staking-as-a-service program. The SEC identified SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH and NEXO as securities, although it described this list as ‘non-exhaustive.’ The judge found that while crypto may be new, ‘the challenged transactions’ fall within the framework used by courts to identify securities for 80 years. The judge also found that the SEC had ‘adequate’ alleged that the staking program qualifies as a security. However, the judge dismissed the claim that ‘Coinbase acts as an unregistered broker by making its Wallet application available to customers.’

‘The 13 Crypto-Assets At Issue:’ Coinbase has contended that ‘secondary market transactions’ of crypto do not implicate securities law, ‘[b]ecause an issuer owes no contractual obligation to a retail buyer on the’ venue. The judge disagreed with Coinbase’s assertion, and as the judge explained, ‘the SEC has plausibly alleged horizontal commonality.’ The judge pointed to the SEC’s charges which outlined how token issuers, developers and promoters ‘frequently represented that proceeds from crypto-asset sales would be pooled to further develop the tokens’ ecosystems,’ implying financial gains for all tokens holders. Additionally, the judge explained that the SEC ‘adequately alleged that staking participants reasonably expect profit based on ‘Coinbase’s managerial efforts.’

The judge dismisses the SEC’s claims regarding Coinbase Wallet: In what has been described as a ‘win,’ the judge dismissed the SEC’s charges related to Coinbase Wallet. The SEC alleged Coinbase acted as an ‘unregistered broker’ but the judge found that the wallet’s technical specifications did not meet that definition. For instance, the judge argued that Coinbase’s participation in the Wallet’s order-routing is minimal. The SEC’s allegations that Coinbase charges a 1% commission, solicits investors to use the wallet, compares prices, and routes orders were found to be ‘insufficient to establish “brokerage activities.”’

CRYPTO HEADLINES

BlackRock's CEO Larry Fink said he was ‘pleasantly surprised’ at the demand for the firm’s spot BTC ETF (NASDAQ: IBIT). In an interview with FOX Business, Fink commented on the product’s growth, highlighting that it’s becoming the fastest-growing ETF in history, amassing assets of USD 13.5B within its initial 11 weeks and averaging daily inflows of USD 260M. - link - @Cointelegraph

BlackRock's tokenized money market fund BUIDL amassed USD 245M in deposits, according to onchain data. Announced last week, BUIDL operates on Ethereum and aims to attract institutional investors by providing steady yields from US Treasury bills and repurchase agreements. Comparatively, Franklin Templeton’s OnChain U.S. Government Money Fund (FOBXX) manages USD ~360M in assets. - link - @CoinDesk

FTX founder and former CEO Sam Bankman-Fried’s sentencing is scheduled for today. In November, Bankman-Fried was found guilty on seven counts of fraud and conspiracy in a US court yesterday. He was accused of using billions of dollars of customer funds to make speculative investments, for personal use, and to fund illegal political campaigns. Prosecutors are seeking a 40–50 year sentence, while Bankman-Fried’s defense argued for a significantly reduced sentence of fewer than 5 years and 3 months. - link - @Reuters

Blockchain game developer Elixir Games raised USD 14M in a seed funding round with contributions from Square Enix, Shima Capital, and the Solana Foundation. The investment will be channeled into the development of Elixir Games' gaming platform, which is expected to debut in 2024, and the introduction of its ELIX token. - link - @TheBlock

BOB has raised USD 10M in seed funding to launch the first BTC layer 2 with Ethereum Virtual Machine (EVM) compatibility. Led by Castle Island Ventures, the funding round included participation from Mechanism Ventures, and Bankless Ventures, among others, and is set to enable Ethereum-style contracts on BTC without overloading the network. BOB, an acronym for "Build on BTC," intends to use BitVM's off-chain computation to maintain efficient network operations. - link - @CoinDesk

Crypto VC firm 1kx raised USD 75M to launch a new fund targeting crypto applications tailored to consumers. The fund is being anchored by Accolade Partners, and includes investment from a16z and Galaxy Digital. 1kx’s previous investments include staking platform Kiln, Pudgy Penguins NFTs, NFT marketplace Rarible, blockchain-based metaverse video game Sandbox. - link - @Bloomberg

WonderFi (TSX: WNDR) released Q4 and FY 2023 earnings, reporting CAD 12.9M in revenues for the quarter, and over CAD 2.5B in crypto trading volumes during the year. Revenue, aggregated across WonderFi’s subsidiaries Bitbuy, Coinsquare and SmartPay, represents a 395% increase over Q2 2022. During the quarter, the company’s cash balance also rose to CAD 37.3M, while total investments rose to CAD 20M. - link - @WNDR

TOP ARTICLES

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

The Crypto Reboot That Wasn't: Why 'FTX 2.0' Floundered, WSJ, March 27, 2024

The WSJ reviews attempts to restart FTX following the exchange's collapse.

CRYPTO MULTIMEDIA

From Slovakia To Panama: Unveiling The Bitcoin ATM Revolution With Paralla Tech, Bitfinex Talks, March 27, 2024

Peter Bešina, the CEO of Paralla Tech, talks about the proliferation of BTC ATMs.

CHARTS OF THE DAY

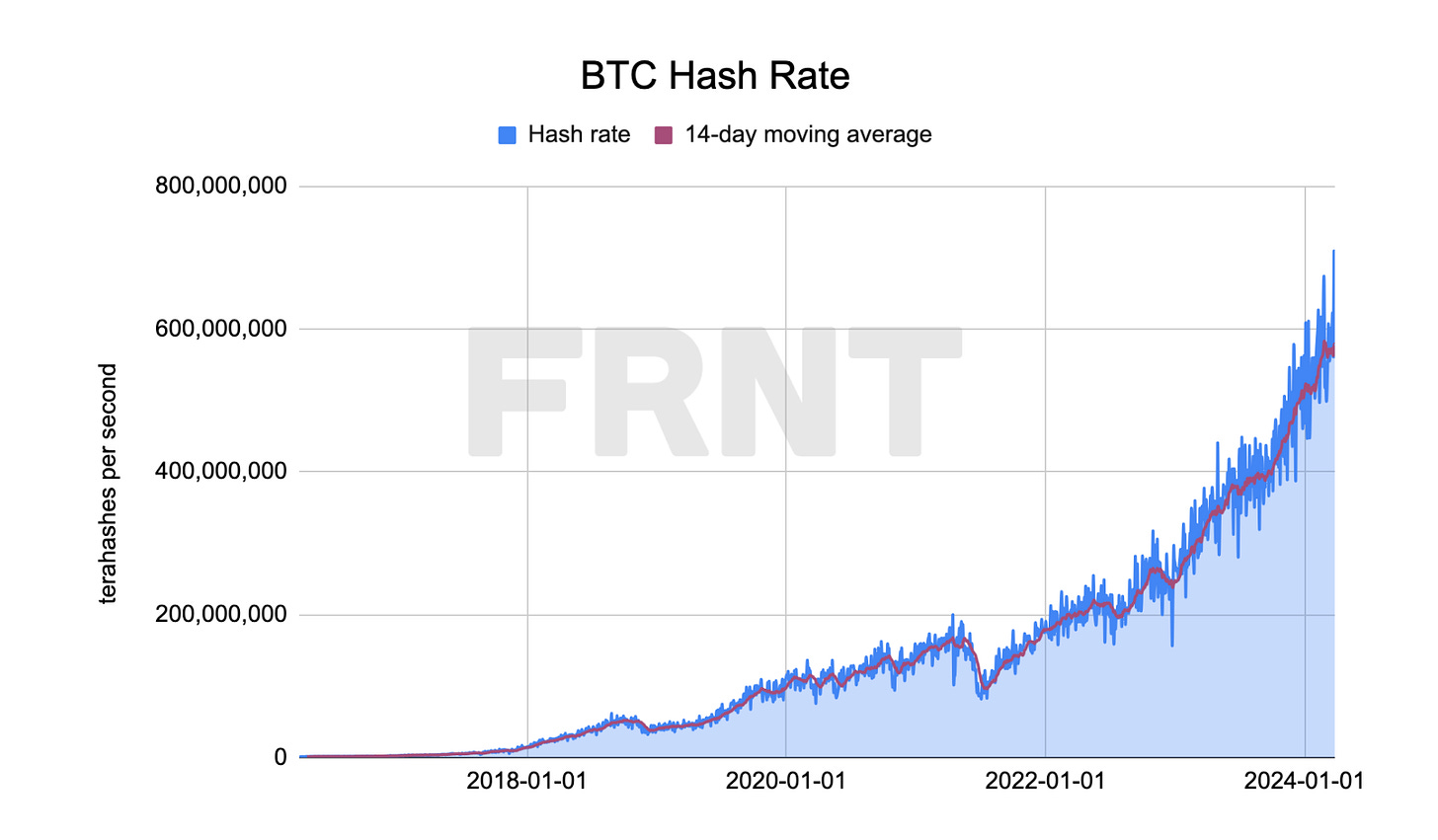

The BTC hash rate, i.e. the computing power devoted to the network, continues to rise with the halving 23 days away, and estimated to take place on April 23...

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.