President-Elect Donald Trump Has Nominated Crypto Proponent Paul Atkins To Head The SEC - Aktins Is A Stark Contrast To Current SEC Chairman Gary Gensler Who Has Overseen Aggressive Regulatory Scrutiny Of Crypto

In a statement posted to this Truth social media platform, Trump wrote that Aktins believes in the US’ capital markets and ‘recognizes that digital assets & other innovations are crucial to Making America Greater than Ever Before.’

For the crypto community, Atkins, who served as SEC commissioner from 2002 to 2008, is not a well-known name. However, he has numerous touch-points with the industry. Atkins is the CEO of Patomak Global Partners, which offers numerous services related to digital assets. Among the firm’s work in the crypto space is assessing ‘compliance programs’ at crypto trading platforms. The firm’s website also describes having worked on ‘assessments of BSA/AML compliance and cryptocurrency custody issues.’ In 2020, Atkins Paul Atkins joined crypto advocacy and lobbying organization Chamber of Digital Commerce’s board of advisors. Since 2017, Atkins has also served as the co-chair of Token Alliance, a working group within the organization focused on token issuances, trading platforms, and other areas under the SEC’s purview. According to a statement from Atkins at the time of appointment to the board of advisors, ‘the Chamber has been a leader in seeking to bring about regulatory clarity for token projects.’ (notably, Perianne Boring, the founder of Chamber of Digital Commerce is reportedly being considered by Trump to head the CFTC).

The crypto community largely welcomed Atkins’ appointment. Crypto news outlets described Atkins as ‘crypto-friendly’ and highlighted his work with the Chamber of Digital Commerce. Atkins will take over the SEC from incumbent chairman Gary Gensler on January 20, when Trump takes office.

Takeaway: Atkins takes the SEC following a highly antagonistic posture towards crypto by Gensler. Under Gensler, the crypto space was under significant regulatory scrutiny. Gensler’s fiercest critics point out that under his tenure the SEC failed to prevent high profile examples of fraud, such as FTX, while prosecuting relatively benign projects such as the Stoner Cats NFT series. In this context, Gensler's departure alone was greeted with elation. Having said that, Gensler’s successor will helm the SEC under a president who has made unprecedented commitment to the crypto space. In this regard, while specifics remain unclear, Atkins will likely represent a significant departure from the hostile and antagonistic approach employed by Gensler.

CRYPTO HEADLINES

Silicon Valley entrepreneur and VC investor David Sacks has been appointed as AI and crypto czar by Donald Trump. Sacks is expected to steer US policy on AI and BTC, with an emphasis on deregulation to promote leadership in technology. He will also chair the Presidential Council of Advisors for Science and Technology. - link - @Bloomberg

The group of US spot BTC ETFs now hold more BTC than the 1.1M coins held in wallets linked to Satoshi Nakamoto. As pointed out by Bloomberg ETF analyst Eric Balchunas, the products achieved the milestone, amassing over USD 110B in assets, in their infancy, having launched less than a year ago. - link - @EricBalchunas

Coinbase’s Ethereum layer-2 network Base reached peak daily transactions of 8.8M yesterday. The total value of crypto locked (TVL) on the platform hit USD 3.6B, boosted by ‘AI agent’ protocols. Network fees also reached a three-month peak. - link - @TheBlock

Medical technology firm Semler Scientific (NASDAQ: SMLR) purchased an additional 303 BTC for USD 29.3M. Since July, the firm claims its BTC strategy has achieved a 78.7% yield. Semler's BTC holdings now total USD ~184M since developing the strategic reserve strategy in May. - link - @SMLR

Story-based protocol Sekai secured USD 3.1M in seed funding for its AI and blockchain ‘storytelling’ platform. By utilizing the Story Protocol, Sekai intends to transform collaborative storytelling and safeguard intellectual property. - link - @TheBlock

Circle announced it is the first stablecoin issuer to ‘commit to comply’ with Canadian regulators for USDC to be available on local platforms. The Canadian Securities Administrators set the compliance deadline for December 31, 2025, and Circle has also gained approval from the Ontario Securities Commission, promoting its use in international and institutional transfers. - link - @Circle

CoinShares (STO: CS) announced its Physical BTC ETP has emerged as Europe's largest Bitcoin ETP by assets managed. The firm credited the product’s success to its tactical product design, low fees, and broad distribution network. CoinShares currently oversees assets exceeding USD 5.4B in BTC ETPs across Europe. - link - @CS

TOP ARTICLES

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

Hodlers: An Apology, FT, December 5, 2024

The FT reacts to BTC's performance.

CRYPTO MULTIMEDIA

Strategic Bitcoin Reserves, Institutional Adoption, And FRNT Financial, Bitfinex Talks Podcast, December 3, 2024

Stéphane Ouellette, CEO of FRNT Financial, discusses the firm's 'innovative solutions for underserved institutional clients,' among other topics.

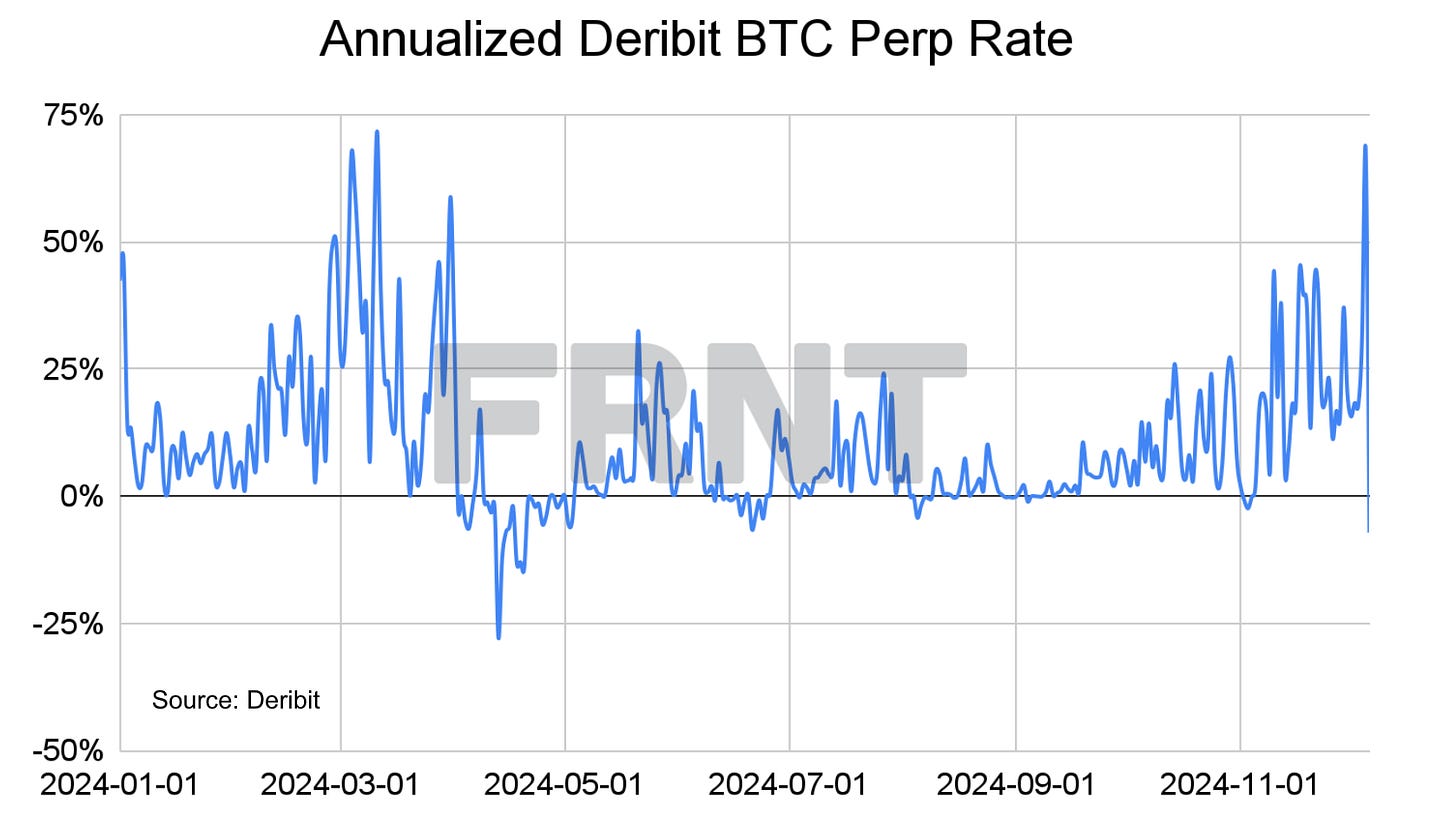

CHART OF THE DAY

The average daily BTC perp rate on Deribit reached 68% yesterday, its second highest level in 2024.

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.