Presidential Candidate Donald Trump Announced A BTC-Based NFT Series - We Discuss The Former President’s Policy Positions Towards Crypto

According to an X post from ‘CollectTrumpCards,’ collectors who purchase 100 NFTs from Trump’s Polygon-based ‘mugshot’ edition, released in December, will now also get a BTC-based ordinals NFT. As the X announcement explained, ‘Bitcoin Ordinals are a new innovative way to inscribe data, such as art, collectibles, or Trading Cards, onto the Bitcoin blockchain. Ordinals can be compared to NFT's, but immutably inscribed on Bitcoin!’ Trump first launched an NFT collection in December 2022.

Trump’s 2016 to 2020 presidency coincided with significant milestones in the mainstream adoption of BTC, namely the launch of BTC futures on CME. However, Trump’s administration also saw relatively antagonistic policy positions towards crypto. For instance, in October 2020, the Department of Justice published an 83-page report on crypto, identifying the space as an ‘emerging threat’ and ‘enforcement challenge.’ According to a book published by Trump’s former national security advisor John Bolton, Trump told his Treasury Secretary Steven Mnuchin to ‘[g]o after Bitcoin [for fraud].’ In addition, in 2019, Trump posted on X that he is ‘not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air.’ The post coincided with significant scrutiny of Meta’s Libra payments project, which was marketed as a cryptocurrency. In his post, Trump also criticized Meta’s project, and concluded ‘[w]e have only one real currency in the USA, and it is stronger than ever, both dependable and reliable.’

Crypto has emerged as a notable topic among some Republican presidential candidates during the primaries. For instance, last year former candidate Vivek Ramaswamy released a crypto policy plan which included protecting code development as a First Amendment right. CoinDesk has described Ramaswamy, who dropped out of the race last week and endorsed Trump, as having ‘enthusiastic support of crypto as a financial innovation.’ Trump, on the other hand, has not made any references to crypto in his campaign to date. However, following Ramaswamy’s endorsement and appearance alongside Trump at a rally, the former president pledged to ‘never allow the creation of a Central Bank Digital Currency’ (CBDC).

Takeaway: For a long time, CBDCs have been a popular topic among crypto proponents who largely oppose such plans due to privacy and civil liberties concerns (Arthur Hayes published a translation of a Chinese CBDC statement in 2016, for example). In this context, some in the crypto community have interpreted Trump’s new CBDC policy as an absorption of some of Ramaswamy positions towards digital assets. Speculating on potential collaboration between Trump and Ramaswamy is beyond the scope of this note. Nevertheless, some crypto proponents are hopeful that the former candidate could dampen Trump’s previous antagonism towards crypto. Moreover, Trump’s foray into NFTs since leaving office could also serve as a basis for more crypto-friendly positions.

CRYPTO HEADLINES

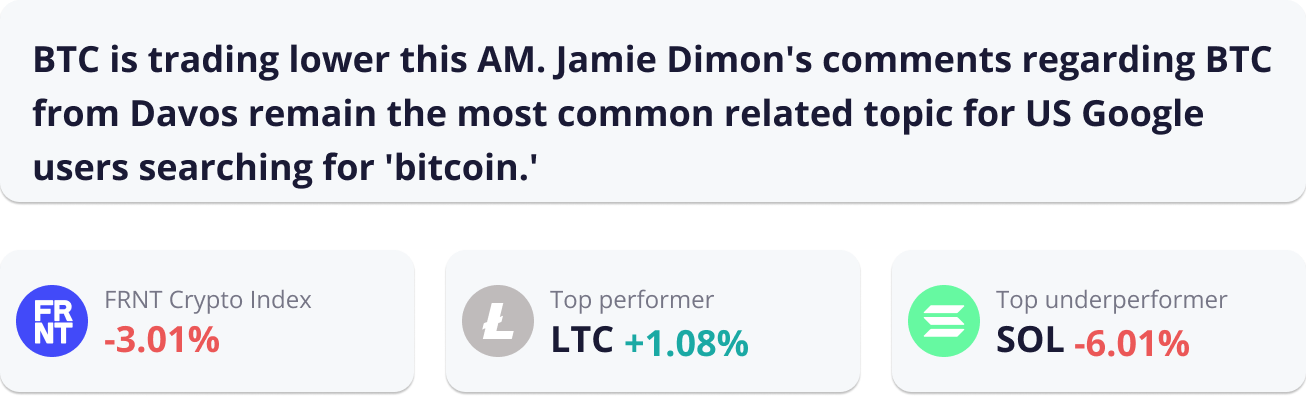

After five trading sessions since their launch, spot BTC ETFs have seen over USD 1.1B in total net flows, and reached an aggregate USD ~26.3B in AUM. Yesterday, Grayscale’s Bitcoin Trust ETF (NYSEARCA: GBTC) saw USD 582M in outflows, and has seen total outflows of USD ~2.2B. The fund had USD ~25B in AUM when it uplisted to an ETF last week. A year ago, the fund was trading at a ~43% discount to its NAV, compared to ~0.50% today. BlackRock and Fidelity’s BTC ETFs are the sole funds to have reached net flows of over USD 1B, while the aggregate AUM of all funds is larger than similar products for Silver and the second largest for commodity ETFs behind gold. In the US, google searches for ‘etf’ are at all-time highs, with ‘bitcoin’ being the top related topic. - link - @EricBalchunas

As expected, the SEC has delayed its decision to accept or reject Fidelity’s spot ETH ETF application until March 5. In an interview following the regulator’s approval of BTC ETFs last week, Gensler explained the approval was limited 'to one non-security commodity.’ In a recent report cited by CoinDesk, JPMorgan analysts placed the likelihood of an ETH ETF by May at ‘no more than 50%.’ - link - @Cointelegraph

Venture Smart Financial Holdings Ltd. plans to submit an application to list a BTC ETF in Hong Kong with the goal of reaching USD 500M in assets by year end. Last week, HashKey COO Livio Weng said nearly 10 firms, which include local and European financial services firms, were exploring launching ETFs and had already begun discussions with local regulators. - link - @Bloomberg

Crypto analytics and compliance firm Chainalysis found that illicit revenue from crypto scams and hacks fell 29% and 54%, respectively, in 2023. The company estimates that total crypto received by illicit addresses fell to USD 24.2B in 2023, compared to USD 39.6B in 2022. However, Chainalysis noted that darknet and ransomware markets saw revenue rises in 2023. - link - @Chainalysis

Crypto exchange HTX temporarily halted services today after being targeted in a ‘DDoS’ attack. The exchange’s servers were down for ~15 minutes before Justin Sun, an advisor to the firm, announced services would resume and that customer funds were ‘'SAFU.' - link - @CoinDesk

TOP ARTICLES

Bloomberg: Bitcoin Drops To Lowest Level Since Approval Of ETFs

Reuters: Spot Bitcoin ETFs Draw Nearly $2 Billion In Fiirst Three Days Of Trading

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

Core Scientific’s Bankruptcy Fortunes Rise And Fall With Bitcoin, Bloomberg, January 18, 2024

Bloomberg reviews Core Scientific's turnaround from bankruptcy.

CRYPTO MULTIMEDIA

Crypto Setting Up For An Explosive 2024, Crypto Options Unplugged Podcast, January 19, 2024

David Brickell, head of international distribution at FRNT, discusses crypto market dynamics and outlooks.

CHART OF THE DAY

NFTs, at one point in the previous crypto market cycle, became the focal point of speculation and interest. However, NFT trading activity has significantly declined since...

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.