The SEC Has Approved 11 Spot BTC ETFs - We Discuss The Watershed Development In This AM’s Note

Since the first BTC spot ETF application was filed in 2013, when one BTC cost less than USD 100, SEC denials of spot BTC ETFs largely focused on concerns related to ‘fraudulent and manipulative acts.’ However, Grayscale challenged the SEC in court, and in August 2023 a court vacated the SEC’s logic paving. As SEC Chairman Gary Gensler explained in a statement, circumstances had changed, and the ‘most sustainable path forward’ became to approve the ETFs.

Three out of the SEC’s five commissioners voted for approval, with Gensler joining the two Republican commissioners in support of the ETFs. Still, Gensler warned that ‘bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity…’ Commissioner Caroline Crenshaw, who voted against the approval, argued that the SEC’s analysis relied on ‘unregulated spot market and a futures market that the SEC itself does not regulate.' Commissioner Hester Peirce criticized the SEC’s track record on BTC ETFs, describing the treatment of applications as ‘arbitrary and capricious.’

The crypto community reacted with elation. BTC proponents pointed out that the approval coincided with the 15-year anniversary of Hal Finney, credited with receiving the first BTC transaction from Satoshi Nakomoto, tweeting ‘Running bitcoin.’ Republican politicians also welcomed the decision. The Chairman of the House Financial Services Committee, Patrick McHenry and the Chairman of the Digital Assets, Financial Technology and Inclusion Subcommittee, French Hill, issued a statement welcoming the ‘historic milestone.’

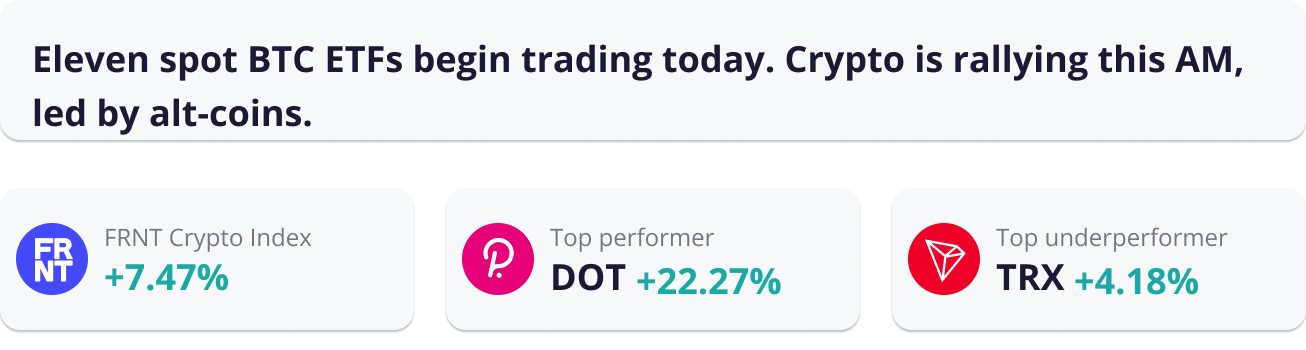

BTC price action was relatively muted on the announcement, with the asset initially trading lower to just below USD 45,000. Into the evening BTC eventually saw its price rise to as much as USD 47,600. Alt-coins outperformed following the announcement as media outlets began to speculate on what other assets could see ETFs down the road. This is despite Gensler explaining that the approval ‘should in no way signal the Commission’s willingness to approve listing standards for crypto asset securities’ in his statement. BTC’s share in the aggregate crypto market cap dropped by ~1.5% since the ETF was approved.

Among other BTC spot ETF-related developments, we would single out the following:

Bitwise Asset Management will donate 10% of profits from its spot BTC ETF, BITB, to fund BTC development.

Franklin Templeton’s X profile changed its profile picture to the firm’s logo with ‘laser eyes,’ a trend started by MicroStrategy co-founder Michael Saylor to signal ‘HODLing.’

Goldman Sachs wrote in a report that institutional investors may benefit from the ETFs, allowing investors to engage in arbitrage strategies and options hedging.

Pre-market trading in some of the BTC ETFs has begun. BlackRock’s iBit leads pre-market volumes with 400,253 shares traded followed by GBTC’s 316,796 shares traded.

Takeway: The approval of spot BTC ETFs is a watershed moment for BTC and the crypto space. As FRNT’s CEO Stephane Ouellette wrote on X, ‘this kicks off a new era of institutional participation…’ With the approval of these ETFs, some of the largest asset managers on the planet now have fully-fledged crypto trading divisions. BTC spot ETFs are likely to serve as a stepping stone to other crypto-related services for their issuers.

CRYPTO HEADLINES

Bank of England Governor Andrew Bailey said crypto has not taken off as ‘a core financial service.’ Speaking before the UK Parliament’s Treasury Committee yesterday, Bailey added that ‘using Bitcoin as a payments method is pretty inefficient,’ and that crypto’s integration into traditional financial markets has not ‘kept the momentum.’ - link - @Bloomberg

European Central Bank (ECB) Executive Board member Isabel Schnabel said the central bank ‘is very unlikely to ever buy Bitcoin.’ In November 2022, the ECB published an article entitled ‘Bitcoin’s last stand,’ arguing the coin was ‘rarely used for legal transactions’ and on ‘the road to irrelevance.’ - link - @ECB

Ripple Labs, the firm behind XRP, plans to buy back USD 285M of the firm’s shares from early investors. The tender offer values the firm at USD 11.3B. Ripple plans to spend USD 500M to cover the tender offer, which will cover converting restricted stock units into shares and taxes. - link - @Reuters

FTX’s bankruptcy estate is preparing to sell its real estate holdings in the Bahamas. The properties, which includes the penthouse previously occupied by former executives including Sam Bankman-Fried, were previously appraised at nearly USD 200M. - link - @TheBlock

X has removed the ability for users to make their profile photos NFTs. According to its support page for Premium users, all descriptions surrounding the NFT profile picture feature have been removed. The feature was initially launched in January 2022. - link - @TechCrunch

NEAR Foundation, the development firm behind the Near blockchain, is laying off 40% of its staff. The headcount reductions target marketing, business development and community teams, the company’s CEO Illia Polosukhin said. - link - @NEAR

TOP ARTICLES

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

Caveat Emptor — Bitcoin Is Out Of The Box For Good, John Authers for Bloomberg, January 11, 2024

Bloomberg columnist John Authers argues 'the green light for ETFs will open the floodgates for retail investors, whatever warnings the SEC tries to offer.'

CRYPTO MULTIMEDIA

SEC's Peirce Calls Approval Of Bitcoin ETF A Milestone, Bloomberg, January 11, 2024

SEC Commissioner Hester Peirce discusses the SEC's decision to approve BTC spot ETFs.

CHART OF THE DAY

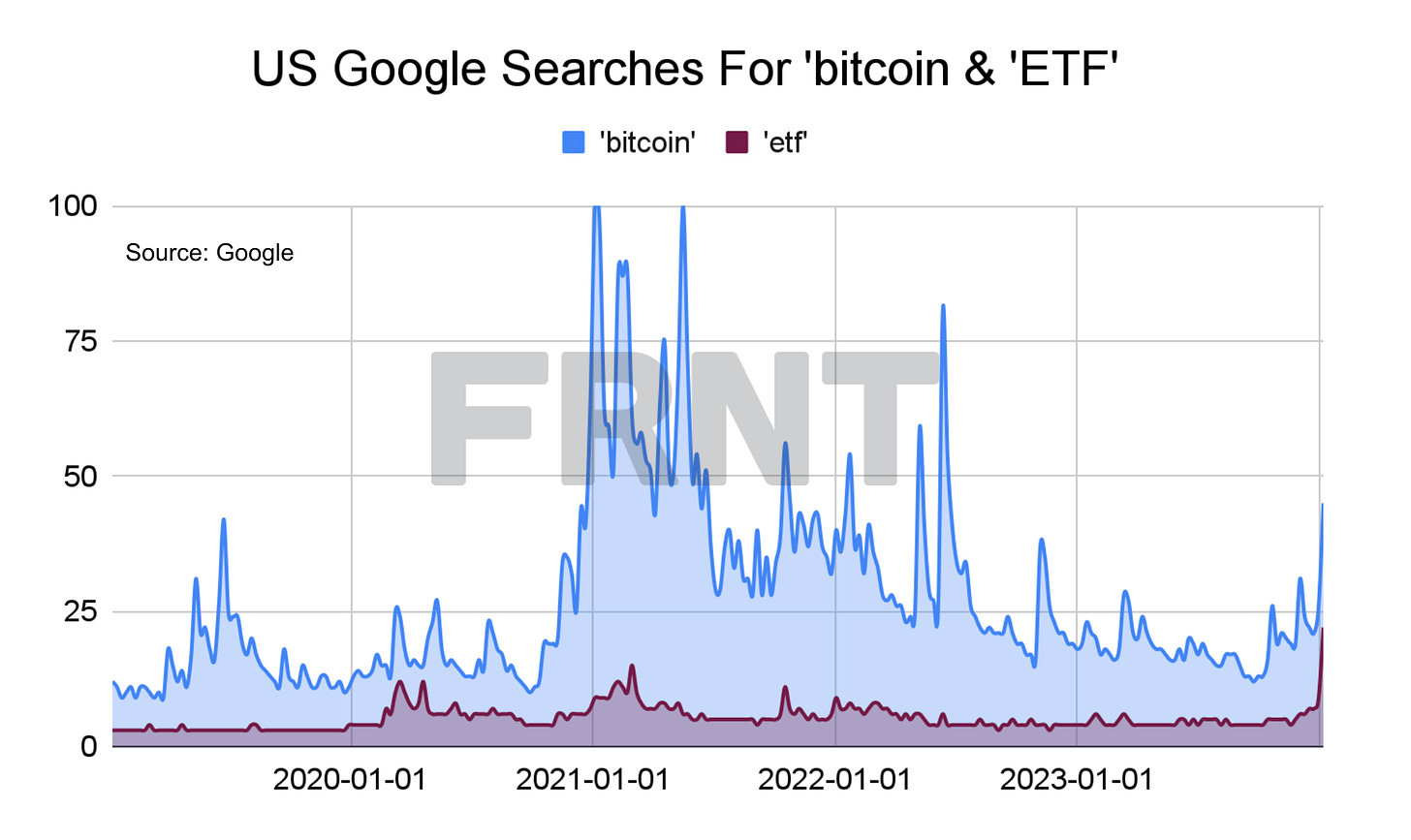

The BTC spot ETF saga has brought renewed attention to BTC, although Google searches for the token remain a fraction of levels achieved in 2021. The term 'etf' is seeing all-time high Google search volume as a result of the approval process …

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.