Speaking At The Libertarian Party Convention On Saturday, US Presidential Candidate Donald Trump Escalated His Support For BTC & Crypto - Trump’s Latest Promises To The Crypto Community Have Stirred Speculation Regarding How Far He Will Go

On Saturday, Trump’s courting of crypto voters began with a post on Truth Social. Trump posted that he is ‘open-minded to cryptocurrency companies, and all things related to this new and burgeoning industry.’ Later on Saturday, Trump, who was making the case for Libertarians to vote for him in November’s election, told the audience he would ‘stop Joe Biden's crusade to crush crypto.’ Trump promised to ‘ensure that the future of crypto and the future of Bitcoin will be made in the USA, not driven overseas. I will support the right to self-custody for the nation's 50 million crypto holders. I say this with your vote: I will keep Elizabeth Warren and her goons away from your Bitcoin, and I will never allow the creation of a central bank digital currency.’

In a notable gesture of solidarity to elements of the crypto community and Libertarian movement, Trump promised to commute the sentence of Ross Ulbricht. Some crypto proponents and Libertarians have lobbied for the release of Ulbricht, who was sentenced to life in prison without the possibility of parole in 2015 for operating the Silk Road, an online black market where BTC was used.

Trump’s embrace of crypto is seemingly already impacting crypto policy in the US. Last week, the SEC took the first step towards allowing spot ETH ETFs to begin trading. The SEC’s turnaround on the issue is attributed to the pressure Trump placed on Biden’s crypto policies by embracing the asset class. In addition to the turnaround on the spot ETH ETF, last week also two separate pieces of crypto legislation made their way through Congress with a surprising amount of bipartisan support. Key democrats like Senate Majority Leader Chuck Schumer and former Speaker of the House Nancy Pelosi have supported the legislation.

Takeaway: Trump’s embrace of pro-crypto policies at the start of the month has proven not to have been fleeting. The candidate has begun describing more concrete policy positions and concessions in order to earn the votes of crypto supporters. Now that Trump is committed to pitching himself as the pro-crypto candidate, and with the election 162 days away, there is speculation surrounding what further steps Trump could take. For example, Trump has a significant number of digital asset-friendly individuals in his orbit that he could appoint to key positions, even as VP, as a way to reward crypto voters.

CRYPTO HEADLINES

Marathon Digital Holdings has entered into a partnership with Kenya's Ministry of Energy and Petroleum to work on renewable energy projects for BTC mining. The agreement will lead to the formation of a committee designated to manage and supervise the BTC-related energy initiatives, which focus on leveraging renewable energy resources within Kenya. - link - @The Block

TD Cowen projected the launch of more crypto funds after Ethereum ETFs received approval. The firm interpreted the SEC's greenlight as a stepping stone towards the acceptance of additional crypto-based funds, potentially paving the way for a collective of crypto tokens. - link - @TheBlock

Recent police raids in China underscore the ongoing use of cryptocurrencies despite official bans. Raids targeted illegal forex transactions involving billions in crypto, highlighting persistent digital-asset activity. The enforcement challenges suggest that the ban is porous, with significant crypto transactions still occurring, reflecting the decentralized nature of cryptocurrency. - link - @Bloomberg

Argentina consulted with El Salvador on BTC adoption. The security regulators from both countries, CNV of Argentina and CNAD of El Salvador, engaged in discussions about crypto adoption and the potential for regulatory collaboration. - link - @Cointelegraph

US spot BTC ETFs saw inflows amounting to USD 107.91M over nine consecutive days. This has been the longest streak of inflows since mid-March. BlackRock's iShares Bitcoin Trust (NASDAQ: IBIT) was at the forefront, receiving USD 89M, with Fidelity and VanEck trailing behind. In contrast, Grayscale's Bitcoin Trust faced a USD 14M outflow during the same period. The first spot BTC ETFs received SEC approval in January, garnering considerable assets swiftly thereafter. - link - @BitcoinMagazine

Delaware's Supreme Court reversed a ruling to dismiss crypto custodian BitGo's lawsuit against Galaxy Digital (TSX: GLXY) over a failed USD 1.2B merger. BitGo is seeking USD 100M in damages, alleging Galaxy intentionally breached their May 2021 merger agreement. The court found the agreement's definition of 'financial statements' ambiguous, allowing the case to proceed. Galaxy maintains the breakup was due to BitGo's non-compliant financial documents and asserts their position is meritorious. - link - @CoinDesk

Nomura (TYO: 8604) and GMO Internet Group (TYO: 9449) will collaborate to examine stablecoin issuance in Japan. The partnership will concentrate on stablecoins pegged to JPY and USD, with the intention of easing processes such as issuance, redemption, and circulation. Nomura will focus on trading and asset management, while GMO will lead tech development. - link - @TheBlock

Crypto exchange Gate.HK withdrew its application for a virtual-asset trading platform license in Hong Kong. The company halted new user registrations, deposits, and marketing as part of a platform overhaul. It plans to cease trading by May 28, complying with local regulations, and has advised users to withdraw assets by August 28. - link - @SCMP

Caitlyn Jenner's X account has shared numerous memecoin promotions, with the authenticity of the posts remaining ambiguous. In a series of posts, along with videos of Jenner and her manager, the account stated that it had not been hacked, and that the content was legitimate. The account also uploaded videos of Jenner and her manager seemingly confirming the genuineness of the promotional posts. - link - @TheBlock

TOP ARTICLES

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

The Conundrum Of Central Planning, Bitcoin Magazine, May 24, 2024

Michael Saylor shares his take on how BTC's integration with the financial system will play out.

CRYPTO MULTIMEDIA

Senator Cynthia Lummis On Why Crypto Now Has Bipartisan Support In Congress, Unchained Podcast, May 24, 2024

US Senator from Wyoming Cynthia Lummis talks about the latest developments in US politics regarding crypto.

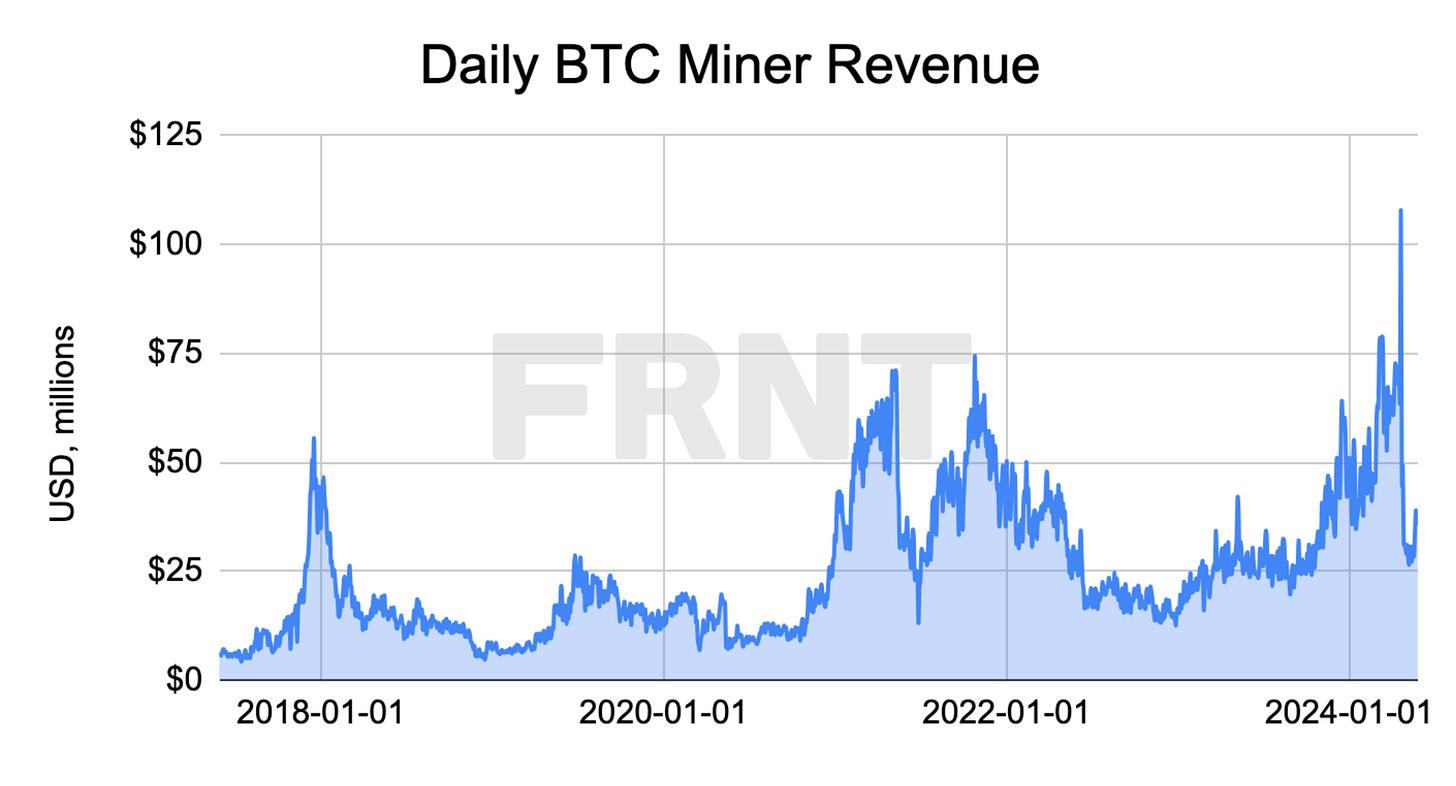

CHART OF THE DAY

Daily miner revenue reached a record high on the day of the Halving in April due to increased demand for transactions caused by the issuance of tokens on BTC. Since, this activity has dissipated and miner revenue has receded to levels previously seen in late 2023...

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.