Eleven Spot BTC ETFs Debuted Yesterday, Recording USD 4.61B In Volume - We Review Trading Dynamics From Yesterday’s Milestone Day

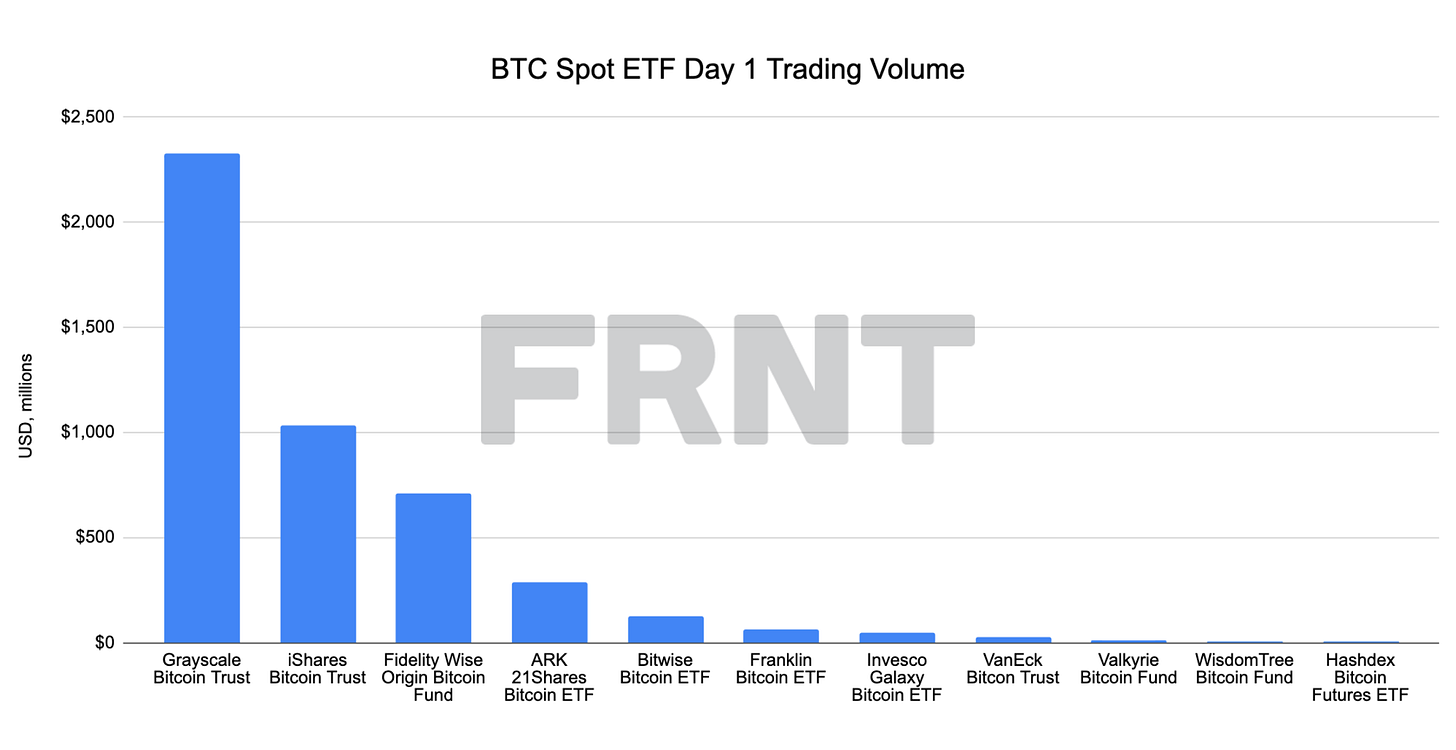

GBTC, which had ‘uplisted’ into an ETF, accounted for half of the volume: BITO, the futures-based BTC ETF, traded just under USD 2B worth of shares, surpassing its record high of USD 1.2B on its debut in 2021. BITO’s first day of trading was the second highest volume for an ETF debut at the time. As Bloomberg pointed out, yesterday’s session also saw numerous records. GBTC’s debut volume of USD 2.3B was the largest ever for an ETF’s first day. GBTC, however, started trading with USD 27B in AUM. BlackRock’s iShares Bitcoin Trust’s USD 1.03B in volume was the fifth largest volume on debut for an ETF. A full picture of the funds' flows likely won't be available until later today.

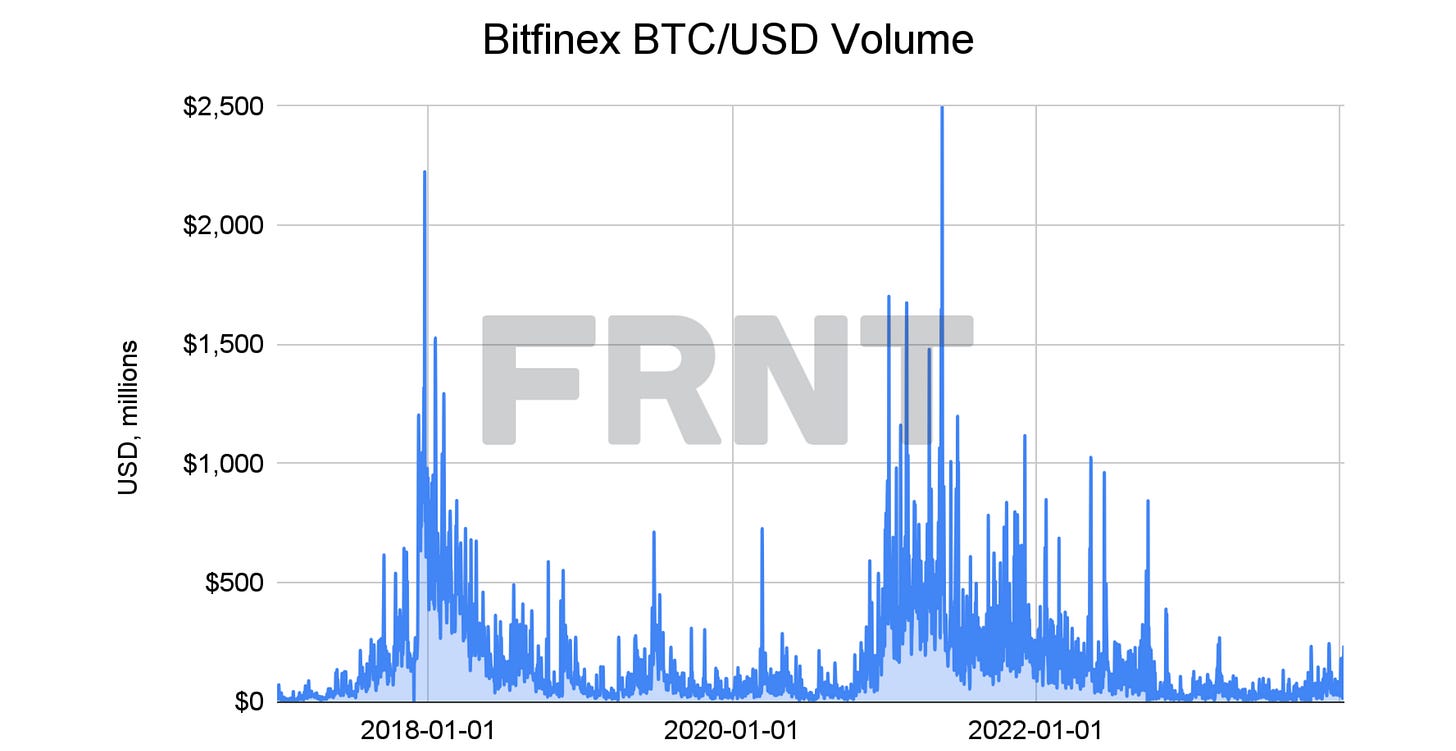

BTC ended the day relatively flat: Just before markets opened, BTC reached USD 48,700, a price previously seen in December 2021. By noon, BTC had sold off to as low as USD 45,600. The asset ended the day’s session at USD ~46,000. In April 2021, on the day of Coinbase went public (NASDAQ: COIN), BTC achieved an at-the-time record high of USD ~65,000. In the week leading up to the IPO, BitMEX perp rates, which are a proxy for demand to be long, averaged 78% annualized. Over that week, average daily spot volume on Bitfinex was USD 446M. In May 2021, however, BTC’s price had fallen to USD ~29,000. BTC has achieved record highs, and subsequently sold off, during other examples of perceived mainstream adoption of the asset: In 2017 BTC reached a record on the same day CME BTC futures were launched, and, in 2021 BTC reached an all-time high in November, 23 days following the launch of BITO. One week ahead of the aforementioned events, BTC/USD on Bitfinex saw average trading volume of USD 840M and 282M, respectively. By comparison, over the past seven days, BTC/USD volume saw an average of USD 108M, while BitMEX perp rates have averaged 11%. As such, Thursday’s spot BTC ETF debut did not come with the type of heated market metrics that have accompanied other events related to mainstream adoption.

BTC spot volumes spiked, but remained modest compared to prior periods: As we alluded to above, spot volumes in the early days of 2024 have remained relatively modest. 24-hour BTC/USD volume on Bitfinex was USD 252M yesterday. This is still less than the daily volume seen in March 2023 during the regional banking crisis in the US. Then, BTC/USD saw a volume reach USD 268M. Moreover, yesterday’s trading activity was multitudes lower than the activity seen in 2017, 2021 and 2022.

Stepping stone to broader crypto-related services: As we noted yesterday, ‘BTC spot ETFs are likely to serve as a stepping stone to other crypto-related services for their issuers.’ Yesterday, Grayscale CEO Michael Sonnenshein said ‘[t]his should be received as a declaration of not only not just having gotten GBTC to market as a spot bitcoin ETF, but our commitment to the product's growth and the ecosystem around the product itself.’ The CEO also revealed the firm plans to file for a covered call ETF with the goal of allowing investors to generate income from options on GBTC.

CRYPTO HEADLINES

BlackRock CEO Larry Fink (NYSE: BLK) said he sees value in having an Ethereum ETF. In an interview with CNBC, describes recent developments as ‘stepping stones towards tokenization,’ and that having a tokenized system ‘eliminates all corruption.’ - link - @CNBC

US Senator Elizabeth Warren said the SEC ‘is wrong on the law and wrong on the policy with respect to the Bitcoin ETF decision.’ In a post on X, Warren, a known crypto critic, added that in light of the ETF approvals it’s ‘more urgent than ever that crypto follow basic anti-money laundering rules.’ - link - @ElizabethWarren

Elon Musk said he is ‘open to the idea of using Bitcoin on X.’ During a Space event on X hosted by Ark Invest’s Cathie Wood, Musk also reaffirmed he owns ‘a lot of DOGE,’ and that SpaceX owns BTC. Musk also described BTC as similar to gold and said the asset isn’t good for payments. - link - @Nasdaq

Vanguard is not allowing its brokerage customers from trading BTC spot ETFs. According to sources cited by Bloomberg, the firm also doesn’t plan to offer a BTC or any crypto-related products in the future. Bank of America (NYSE: BAC) is still determining whether it will provide its clients access to the products on its Merrill Edge platform. - link - @Bloomberg

CoinShares (STO: CS) exercised its option to purchase fellow crypto asset manager Valkyrie’s ETF business. The company said the decision stems from ‘positive developments in the US regulatory landscape,’ and will contribute USD 110M to its current USD 4.5B in AUM. - link - @CS

South Korea’s Financial Services Commission (FSC) said local brokerage firms offering offshore BTC spot ETFs may be violating the law. The regulator also noted it plans to continue its review of existing regulation surrounding crypto given that ‘there are overseas cases, such as in the [US].’ - link - @Reuters

TOP ARTICLES

WSJ: Bitcoin ETFs Get Off To A Monster Start, Despite Resistance On Wall Street

Barron's: Bitcoin Sees Volatile Trading As Investors Pile Into Crypto Tokens And ETFs

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

Bitcoin ETF Trades Top $4.6 Billion in ‘Ground-Breaking’ Day, Bloomberg, January 11, 2024

Bloomberg shares its insights regarding yesterday's spot BTC ETF debut.

CRYPTO MULTIMEDIA

Why Some Brokerage Firms Are Blocking Access To Spot Bitcoin ETFs, Unchained Podcast, January 12, 2024

Nate Geraci, president of the ETF Store and Bloomberg Inteligence’s Eric Balchunas and James Seyffart discusses yesterday’s first day of BTC spot ETF trading.

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.