Strive Asset Management, founded by Trump ally & ‘Department of Governmental Efficiency’ (DoGE) co-lead Vivek Ramaswamy, has filed to list the ‘Bitcoin Bond ETF’ - The prospective ETF seeks exposure to convertible bonds of companies using proceeds to buy BTC

According to documents filed yesterday, the Strive Bitcoin Bond ETF aims to provide exposure to ‘bitcoin bonds,’ described as ‘convertible securities issued by MicroStrategy’ (NASDAQ: MSTR) used to raise funds to purchase BTC. A statement from Strive explains that the ETF, the ‘first of many planned Bitcoin solutions, will democratize access to Bitcoin bonds…’ Strive describes these bonds as ‘attractive risk-return exposure to Bitcoin’ that are ‘not available to be purchased by most investors.’

MicroStrategy has relied on convertible bonds to raise USD ~6B in order to purchase BTC. Some of MicroStrategy’s bonds have no interest, with maturity dates ranging from 2027 to 2032. In the USD 42B ‘21/21 Capital Plan’ that the firm revealed in October, MicroStrategy outlined plans to raise USD 21B via an at-the-market equity offering and USD 21B using fixed income securities. MicroStrategy, however, is not the only firm offering ‘bitcoin bonds.’ For instance, BTC miner MARA Holdings (NASDAQ: MARA) has raised USD 1.92B ‘from 0% convertible notes in November and December.’ Similarly, Riot Platforms (NASDAQ: RIOT) raised USD 594.4M in December through an offering of 0.75% convertible senior notes due 2030.

In 2024, the corporate adoption of BTC as a treasury asset has seen an uptick. Publicly listed firms are using a variety of BTC acquisition strategies. In May, Alliance Resource Partners NASDAQ: ARLP) revealed they are mining and holding BTC using excess energy at a mine in Kentucky. Other firms, such as medical diagnostics firm Semler Scientific (NASDAQ: SMLR), have purchased BTC with ‘excess cash.’ Semler has also used proceeds from its ‘at-the-market equity program’ to fund the BTC acquisitions.

Takeaway: MicroStrategy remains an outlier in the extent to which it has embraced BTC. However, the firm has pioneered the ‘bitcoin yield’ metric and essentially discovered substantial demand for bonds that offer exposure to BTC. Having said that, it remains to be seen what kind of demand for ‘bitcoin bonds’ will exist in the format of an ETF.

CRYPTO HEADLINES

KULR Technology Group (NYSEAMERICAN: KULR) has made its first strategic BTC investment, acquiring 217.18 coins for USD ~21M. The firm, which describes itself as a ‘leader in advanced energy management platforms,’ announced plans to adopt a BTC treasury strategy earlier this month, and plans to make ongoing purchases going forward. Since announcing the treasury strategy, KULR’s market cap has grown from USD ~350M to USD 1.15B. - link - @KULR

Bitwise Asset Management filed to launch an ETF compiled of stocks with BTC treasury strategies. The Bitwise Bitcoin Standard Corporations ETF will invest in companies that have ‘adopted the “bitcoin standard,”’ with weights determined by the value of BTC holdings rather than market caps. - link - @TheBlock

MicroStrategy (NASDAQ: MSTR) called a shareholder meeting seeking to issue additional common shares to fund BTC purchases. The firm proposed raising the amount of authorized Class A shares from 330M shares to 10.33B shares, and preferred stock from 5M shares to over 1B. The move is part of the firm’s ‘21/21 Plan,’ which involves buying USD 42B of BTC over the next three years. - link - @Cointelegraph

Tether has invested USD 2M in a blockchain-focused VC fund managed by Arcanum Capital. James McDowall, managing partner at the firm, said the fund will focus on projects aiming to improve remittances, cross-border payments, privacy, and enabling the unbanked to access banking services via blockchain-based solutions. - link - @Cointelegraph

Trrue, a layer-1 blockchain focused on ESG compliance, received USD 10M in funding from GEM Digital. The investment, for which GEM Digital will receive the protocol’s native token, TRRUE, will go towards developing the Ireland-based platform. - link - @CoinDesk

Israel’s securities regulator approved six mutual funds tracking the price of BTC to launch on December 31. The funds, the first of their kind, have varying strategies to achieve their objective, with some tracking BlackRock’s IBIT, while others track indices published by providers including S&P and Chicago Stock Exchange. - link - @TheBlock

TOP ARTICLES

Wall Street Journal: Justin Sun Wants To Be The Musk Of Crypto

Bloomberg: Bitcoin Rally Fizzles As Token’s Record-Breaking Year Winds Down

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

How Bitcoin Views Are Evolving Among Corporate America’s Cash Managers: CNBC CFO Council Survey, Bloomberg, December 19, 2024

CNBC overviews the results from a survey of US CFOs.

CRYPTO MULTIMEDIA

Why Singapore Is Ahead Of Hong Kong In Crypto Hub Race, Bloomberg, December 24, 2024

Bloomberg's Suvashree Ghosh explains why Singapore is perceived to have moved ahead of Hong Kong in courting crypto firms.

CHART OF THE DAY

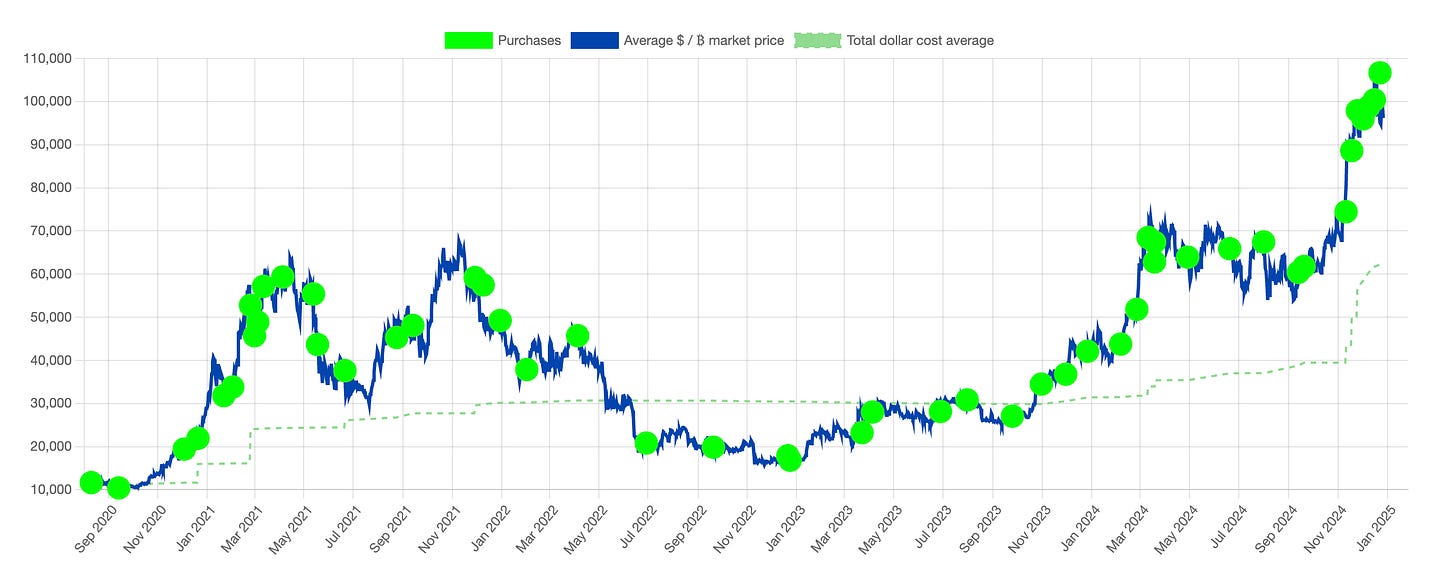

Michael Saylor has shared this chart on X with the comment, 'I think http://saylortracker.com needs more green dots' ahead of the company announcing new purchases of BTC. Saylor has described the company's strategy as acquiring and never selling as much BTC as possible. (Source: Saylortracker.com).

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.