BTC ETF Trading Dynamics & Larry Fink's New Endorsements

The daily crypto update for institutional investors

Preliminary Accounting Data From Bloomberg Suggests BTC Spot ETFs Took In USD 1.4B In ‘New Cash’ In Their First Two Days Of Trading - Meanwhile, BlackRock CEO Larry Fink Has Further Endorsed Core BTC Selling-Points

While the BTC spot ETF trading volume was available last week in real time, a full picture of flow data only emerged at the end of Friday. According to Bloomberg data, the new ETFs took in USD 1.4B in ‘new cash…overwhelming [GBTC's] [USD 579M] of outflows for a net total of USD 819M].’ In regards to trading volume, the new ETFs saw a total of USD 7.85B after their first two days of trading. Bloomberg data has also revealed BlackRock’s iShares Bitcoin Trust as holding USD 500M, the highest AUM among the new ETFs excluding GBTC. Fidelity’s Wise Origin Bitcoin Fund is in second with USD 427M, followed by Bitwise’s Bitcoin ETF with USD 225M. GBTC, which ‘uplisted’ into an ETF last week, began trading with ~USD 28.89B AUM. Including GBTC, the new ETFs now hold a total of ~663,000 BTC. Without GBTC, the new ETFs hold ~33,000 BTC. For comparison, MicroStrategy (NASDAQ: MSTR) holds 189,150 BTC. As we wrote last week, Thursday’s and Friday’s ETF debuts set numerous records in terms of volume.

Speaking to CNBC on Friday, Fink remarked that he believes BTC ‘goes up as if the world is more frightened, if people have fearful geopolitical risks, they’re fearful of their own risk.’ Fink added that ‘t’s no different than what gold represented’ over thousands of years, but unlike the precious metal, ‘we’re almost at the ceiling of the most of the amount of Bitcoin that could be created.’ In an interview with Fox Business, Fink reiterated the view that BTC is an attractive asset for those with distrust towards various government policies. In addition, Fink added that if you are ‘frightened that your government is devaluing its currency by too much deficits…’ The host responded, ‘like us,’ to which the CEO said, ‘I’m not gonna go there.’

Takeaway: BTC proponents have welcomed the BTC spot ETFs as an opportunity for a wider range of investors to become introduced to the asset. BlackRock CEO Larry Fink’s remarks, part of broader marketing efforts aimed at supporting the ETFs, are likely serving this role. While BTC is often pitched as a ‘speculative asset’ by its critics, Fink’s comments are directly promoting core features that have been well known to the coin’s long-time proponents. As we noted ahead of the ETFs’ launch, the marketing associated with these products may serve to bring previously niche topics to a broader audience.

CRYPTO HEADLINES

Genesis will pay the New York Department of Financial Services USD 8M and surrender its BitLicense as part of a settlement over its anti-money-laundering and cybersecurity programs. After two separate investigations between 2018 and 2022, the regulator found the bankrupt lender failed to maintain adequate AML practices and file sufficient Suspicious Activity Reports. Genesis is also forced to cease operations in New York. - link - @Reuters

GameStop (NYSE: GME) will wind down its NFT marketplace next month. The company said the decision was driven by ‘the continuing regulatory uncertainty of the crypto space,’ the same reason it cited when it phased out its crypto wallet feature in the fall. - link - @Cointelegraph

SEC Chair Gary Gensler said last week’s BTC spot ETF approval was limited 'to one non-security commodity.’ Asked during an interview if the court’s decision around BTC set a precedent for the approval of other crypto exchange traded products, Gensler expressed the approval was specific to ‘Bitcoin,’ drawing comparisons to ETFs for gold and silver. - link - @ScottMelker

Bitfinex blocked an attempted hack over the weekend involving a fake transfer of USD ~15B worth of XRP. The exchange's CTO, Paolo Ardoino, said the attacker tried to compromise Bitfinex by exploiting the 'Partial Payments' feature, a unique aspect of XRP's ledger functionality. - link - @CoinDesk

The SEC released a statement on the security breach of its X account which led to a false announcement that BTC spot ETFs had been approved. The account posted the fake announcement the day before the regulator proceeded with legitimate approvals of the products, and also posted ‘$BTC.’ SEC Chair Gary Gensler said the authorized party gained access to the account ‘by obtaining control over the phone number associated with the account,’ and that ‘there is currently no evidence that the unauthorized party gained access to SEC systems, data, devices, or other social media accounts.’ - link - @SEC

Moody’s said increased adoption of tokenized funds signals ‘untapped market potential.’ In a report, the firm said tokenized funds improves the efficiency of investing in assets, such as government bonds, and noted tokenized securities issuances grew from USD 100M to USD 800M in 2023. - link - @TheBlock

TOP ARTICLES

WSJ: Grayscale Faces New Risk-Management Challenge With Bitcoin ETF Approval

Bloomberg: SEC Had A Fraught Cyber Record Before X Account Was Hacked

OPEN-SOURCE RESEARCH / LONG-READ OF THE DAY

Once Dominant NFT Marketplace OpenSea Is Touting Differentiation After Pullback, Bloomberg, January 14, 2024

Bloomberg reviews NFT marketplace OpenSea.

CRYPTO MULTIMEDIA

Bitcoin ETFs Not Good For Coinbase: Mizuho's Dolev, Bloomberg, January 12, 2024

Mizuho Securities Senior Analyst of Fintech Equity Research, Dan Dolev, discusses the impact Bitcoin ETFs could have on crypto platforms such as Coinbase.

CHART OF THE DAY

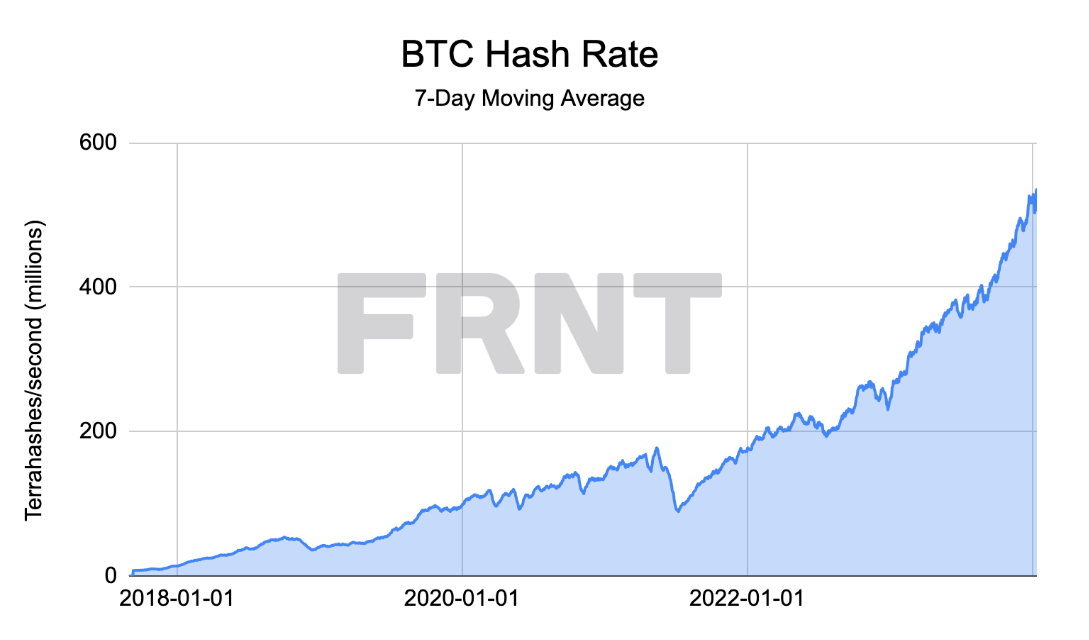

The BTC hash rate, or the computing power devoted to mining the network, has continue to push towards new record highs...

About FRNT Financial

FRNT: TSXV is an institutional capital markets and advisory platform focused on digital assets. FRNT aims to bridge the worlds of traditional and web-based finance. Business lines include deliverable trading services, structured derivative products, merchant banking, advisory, consulting and principal investments.